U.S. Securities and Exchange (SEC) Commissioners Hester Peirce and Mark Uyeda have slammed the SEC over an "endless series of misguided and overreaching cases" in a recent statement.

The dissenting commissioners pointed to the SEC’s treatment of Flyfish Club, LLC, a "high end" restaurant chain that recently settled with the SEC.

Flyfish Club sold NFTs during 2021 and 2022 to provide members an exclusive way to access a yet-to-be-built restaurant and bar ahead of its opening.

Earlier this week, the club agreed to “destroy all Flyfish NFTs in its possession,” pay a civil penalty of $750,000, as well as stop collecting royalties from the sales of the NFTs on secondary markets.

The project was backed by prominent online entrepreneur Gary Vaynerchuk, and the chain is set to open its first restaurant in New York’s wealthy Upper East Side later this week.

Flyfish created approximately 3,000 NFTs ahead of the launch, raking in total proceeds of $14.8 million for the sales. Prices for the upper-tier NFT offering, dubbed “Omakase” NFTs, reached up to $14,300 according to Commisoners' statement.

The SEC’s recent judgment did not allege that Flyfish Club had engaged in fraud, only that they failed to register their NFT collection as securities. The SEC justified the recent judgment, by saying they had told NFT buyers they could “potentially profit” from buying the NFTs.

But Commissioners Peirce and Uyeda accused the SEC of being overzealous with their application of securities law to NFTs.

“The securities laws are not needed here, and their application is harmful both in the present case and as future precedent,” said the Commissioners. “The Flyfish NFTs were simply a different way to sell memberships.”

They added: “Why shouldn’t a chef be able to sell memberships to eat at her kitchen table and to collect royalties on resales of those memberships?”

The statement expressed enthusiasm about the potential of creative people, like chefs or artists, to make money from their work, saying that these type of experiments are “not a threat to the American investor.”

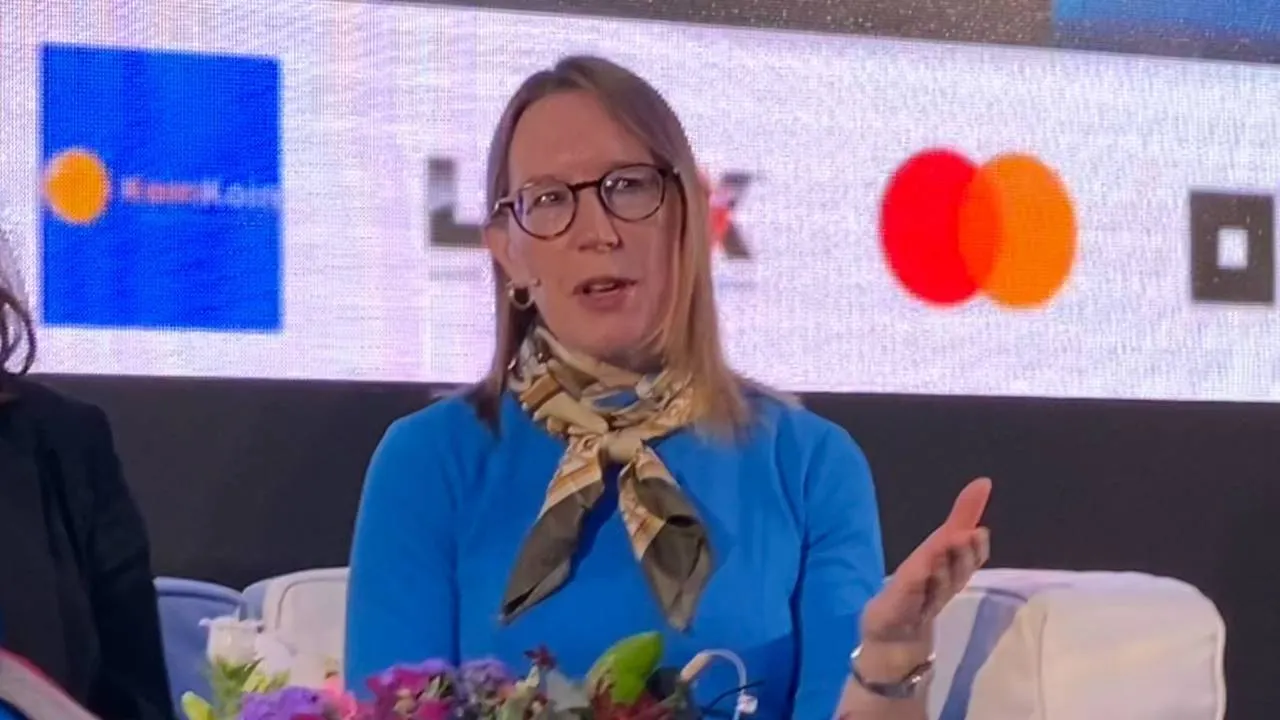

Edited by Stacy Elliott.