Bitcoin has fallen below $65,000 to its lowest price in a month, while the recently launched zkSync token was the biggest loser in the top 100 coins by market capitalization.

The total market capitalization of the entire cryptocurrency space tumbled from $2.55 trillion to $2.48 trillion, a decrease of 2.5%, according to CoinGecko.

Leading cryptocurrency Bitcoin fell to $64,548 in the past 24 hours, thus recording its lowest level in the past one month. Last week, Bitcoin fell to $65,240 after longs worth $150 million were liquidated. But as of Tuesday morning, the Bitcoin price has stabilized around the $65,600 mark.

Crypto heavyweights like Ethereum, BNB, and Solana saw a downtick of 3%, 1.5%, and 5%, respectively.

XRP and Ondo were the only coins in the top 100 that bucked the trend and registered an increase of 2.5% and 2.2%, respectively.

The recently launched zkSync token (ZK) was the worst performer among the top 100 coins. It saw a downtick of 26% in the past 24 hours.

Last week, institutional investors were net sellers across institutional crypto products as Bitcoin ETFs witnessed net outflows to the tune of $621 million. The trend continued yesterday, as net outflows from U.S. spot Bitcoin ETFs touched $145.9 million yesterday, according to investment management firm Farside Investors.

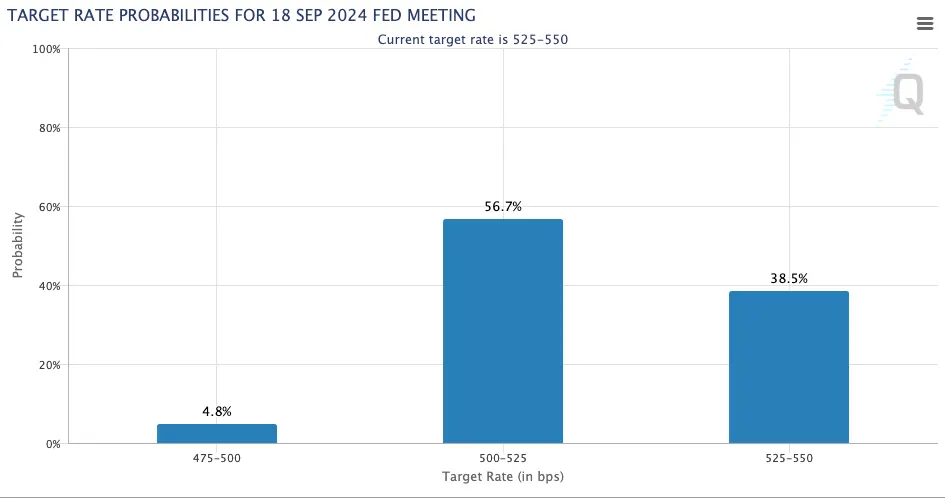

The primary reason behind the lack of confidence from institutions appears to be the Federal Reserve’s increasingly hawkish stance. At the start of the year, the dot plot indicated three rate cuts. But the most recently FOMC meeting showed that the committee now expects to make only one rate cut.

Then on Sunday, Minneapolis Federal Reserve President Neel Kashkari said that the Fed might not cut rates until December—which further dampened the mood of the market. Up until then, investors seemed optimistic that the Fed would cut rates in September, according to the CME FedWatch Tool.

Crypto liquidations reached $500M in the past 24 hours, with the vast majority—$432 million—coming from of long positions that have been forced to liquidate.

There's some optimism, though. A Wintermute trading desk note shared with Decrypt said the market downtrend might not last long.

“Current bearish sentiment may be short-lived as global central banks, like the Bank of Canada and the European Central Bank, have already initiated rate cuts, suggesting a global shift towards monetary easing,” the firm wrote.

However, the note also suggested that Bitcoin miners aren't done selling their BTC holdings to fund their operations or upgrade their hardware. Miners saw a brief boost in their profitability when Runes launched during the recent Bitcoin halving event. But lately interest in Runes is dwindling.

The potential for Mt. Gox creditors being repaid is an additional cause for worry, Wintermute added in its note. It could flood the market with 137,980 BTC, worth approximately $9.04 billion at the time of writing, into the market. Analysts have been saying it would likely create a sudden jolt of sell pressure.

Edited by Stacy Elliott.