In brief:

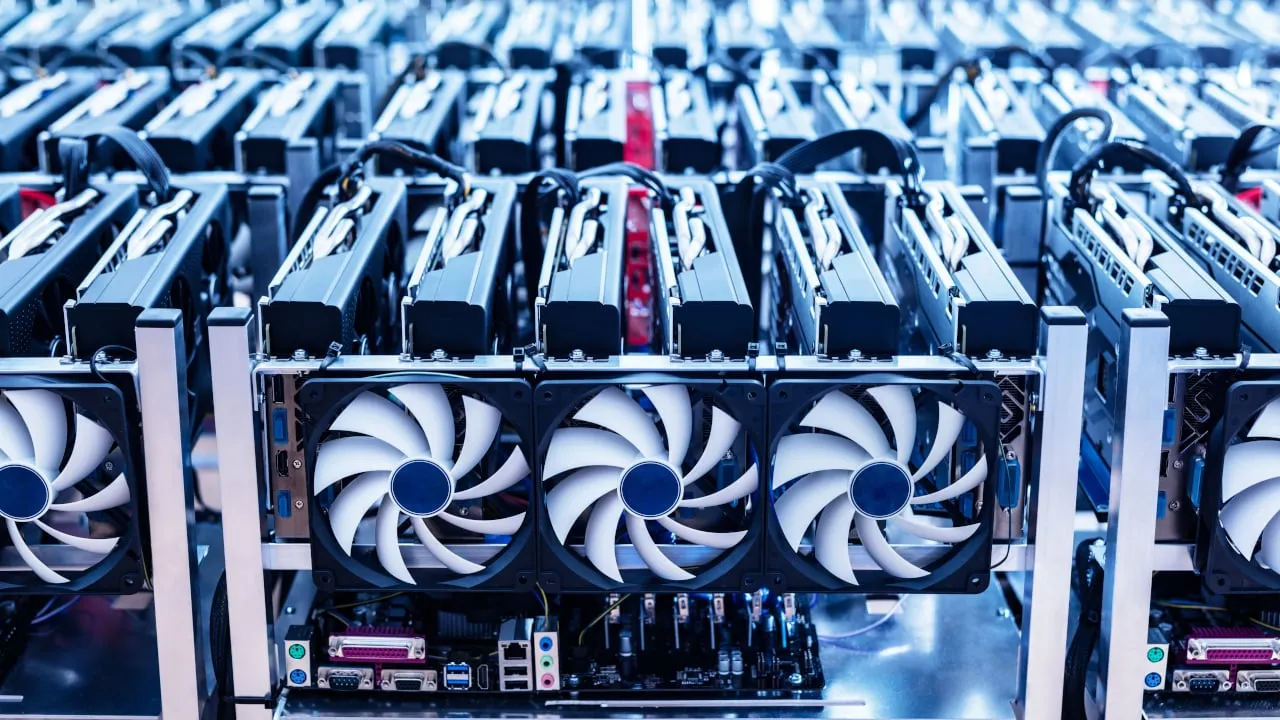

- Retail Bitcoin miners are laying down their rigs as profitability wanes.

- More miners may be forced to yield after the Bitcoin halving.

- There's still a sliver of hope for retail miners.

The Bitcoin halving is seven days away. It's the moment many crypto speculators and Bitcoin bulls have been eagerly anticipating. But for retail miners, the enthusiasm—and profitability—has run dry.

Bitcoin's imminent halving is set to rock retail miners unless a hefty price swing occurs. That's according to several retail miners, most of whom are unprofitable ahead of Bitcoin's quadrennial event.

Come the halving, Bitcoin's block reward—the prize for verifying a block of transactions—will drop from 12.5 BTC per Block mined to 6.25 BTC, reducing profitability for all but the most established firms.

This is certainly the case for Mr. Kristof, a popular crypto YouTuber and, until recently, Bitcoin miner. Speaking to Decrypt, Kristof explained that he had to shutter his operations due to mounting unprofitability.

"I've also been apprehensive to buy newer miners as the halving will cut those profits down," he said. "Just doesn't make sense to buy new machines with market uncertainty at this point. Post halving will make it worse with my current machines."

Kristof isn't alone.

Bitcoin miner Mehran Fani said that his breakeven point would land between $13,500-$15,000 after the halving—a figure that would undoubtedly price most miners out of the runnings with the price of Bitcoin currently hovering around $8,900.

"Miners will care more about the most efficient miners for their next expansion season," Fani said, adding that the high failure rate of the Antminer s17 makes these machines unreliable.

When it comes to Bitcoin mining profitability, there are several fluctuating factors to account for. The price of Bitcoin, the cost of electricity, the efficiency of the mining rig, and Bitcoin difficulty. If any of these fall out of equilibrium, profitability can wane.

Diminishing returns

Indeed, Bitcoin mining conditions have been steadily worsening for retail participants over the years.

According to a recent report by Alejandro De La Torre, the vice president of Poolin—China's largest Bitcoin mining pool—today's mining industry boasts "100 times the level of competition" compared to four years prior. This is exacerbated by the ever-increasing efficiency of mining rigs, of which larger firms are in no short supply.

As a result, De La Torre submits that most retail miners will likely capitulate in the wake of the halving.

"We expect most of these miners will shut down after the halving," argued De La Torre. However, he does caveat that some miners will be able to scrape together enough cheap electricity to survive.

“After the first difficulty adjustment, some older miners may turn back on, but as new more efficient ASICS come online in the coming months and existing miners find lower electricity prices, old generation miners will inevitably be phased out,” he said.

Nevertheless, not all retail miners are down and out; some have formed crafty means of subverting the profitability lull. For Rene Marhold, a Bitcoin miner and producer of mining containers, this involves selling surplus mining energy.

"At the moment we sell around 2 MW heat to companies," Marhold told Decrypt. "That's an additional €30 [$33] per MWh we earn to [each] Bitcoin, so we produce lots cheaper as we don't throw away that energy."

Marhold advises that other miners can keep afloat by selling the extra heat as well.

There is, however, another way they can survive. For these capitulated miners to re-enter the sector, Bitcoin's price would need to at least double—breaking its all-time high of $20,000. It's possible, but whether it will actually happen is a different story.

Tips Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.