In brief:

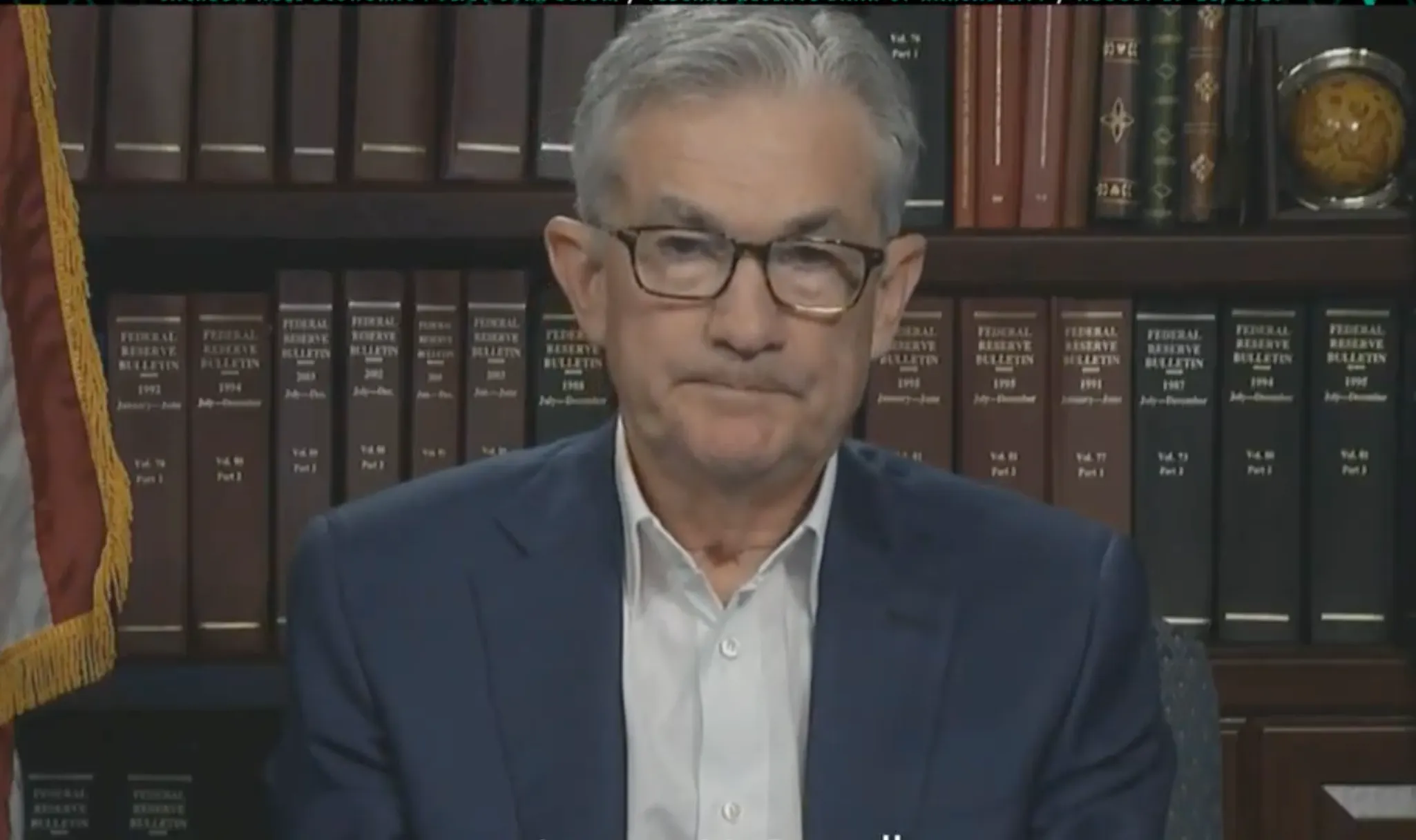

- Fed Chair Jerome Powell announced a new strategy called “average inflation targeting.”

- Inflation will be allowed to run above the traditional 2%.

- The move may lure more investment into stocks and assets like Bitcoin.

The Federal Reserve says it is pushing aside a 40-year-old practice of lifting interest rates to stave off higher inflation in favor of a new approach.

Fed Chairman Jerome Powell announced the move Thursday in a speech at the Jackson Hole Economic Symposium conference, which has been forced to go virtual because of the coronavirus.

The new policy dubbed “average inflation targeting” means the central bank will be more apt to allow inflation to run higher than the standard 2% target before hiking interest rates.

It also means the Fed will be less inclined to increase interest rates when the unemployment rate falters—so long as inflation creeps up as well. (Central bank officials have traditionally believed that low levels of unemployment correspond with higher inflation.)

In his speech, Powell touched on one of the painful lessons of the 1970s—when consumer price inflation, which was running below 2% in the early 1960s, had risen into the double digits—but also cautioned that nearly a decade of low inflation carries its own troubles.

“Many find it counterintuitive that the Fed would want to push up inflation,” he said in prepared remarks. “However, inflation that is persistently too low can pose serious risks to the economy.”

What does this mean?

The news could be good for those folks looking for "easy money."

Many investors say the stock market is propped up by the Fed’s $3 trillion of freshly printed money—created in an effort to avert economic crisis during the coronavirus. This has brought a slew of “easy money” folks—among them Barstool Sports’ David Portnoy, who has recently gotten into day trading and dabbling in cryptocurrency—into the stock market.

In the old way of doing things, if inflation started to rise up above 2%, the Fed would be under the gun to raise interest rates to keep it from going any higher. But now, in the new model, the central bank has agreed to allow inflation to run “moderately” above the Fed’s 2% goal.

With the pressure off, the Fed can ostensibly keep printing money to stimulate the economy. (Remember the Fed has a dual mandate to foster economic conditions that achieve both stable prices and sustainable employment.)

That means that there will be potentially even more cash flowing into the stock market and—as DeFi startup founder and Cornell Professor Emin Gün Sirer predicted in June—into assets such as Bitcoin. Although, Bitcoin is also inclined to be wildly volatile. It doesn't always go up.

“Stocks are overvalued by every traditional metric, and the money on the sidelines will look for worthy investment venues,” he told Decrypt at the time. “I expect a rekindled interest in crypto, a bull run.”