In brief

- There’s little consensus of opinion about Bitcoin's value among big investment banks.

- While some banks have set up digital asset units, others have attacked Bitcoin over its volatility and environmental impact.

Bitcoin is now the world’s third-largest currency, according to a report by Deutsche Bank. And with the cryptocurrency soaring 750% to reach $60,000 this month—and a market cap in excess of $1 trillion—it’s become too big for the banks to ignore. But there’s little consensus among the big investment banks as to whether the asset class is a long-term value proposition—or even whether it’s a proposition at all.

US Federal Reserve chair Jay Powell has said that crypto assets are more for speculation than for payments; many banks agree, but sometimes their actions speak louder than their words. Here’s how the banks stack up in their views on Bitcoin.

1.CitiGroup

Multinational investment bank Citigroup was one of the first big banks to wade into cryptocurrencies. In 2018, it came up with a way to invest in cryptocurrencies without actually owning them.

Most recently, the bank consolidated its views on the cryptocurrency market in a lengthy report published in March 2021, in which it claimed that Bitcoin is “at the tipping point” for mainstream adoption. The bank did highlight some concerns, most notably over custody, capital efficiency, insurance, and the environmental impact of cryptocurrency mining—the energy-intensive process by which new coins are issued.

But ultimately, its prognosis was positive. Bitcoin “may be optimally positioned to become the preferred currency for global trade,” was its bullish high point.

2. Bank of America

While Citi has taken a broadly positive stance on Bitcoin, the same can’t be said for Bank of America, the second-largest bank in the US. In March 2021, it issued a research note to its clients that slammed the cryptocurrency, arguing that because its supply is controlled by a small number of people—known as whales—Bitcoin isn’t a suitable hedge against rising inflation.

In the report, titled “Bitcoin’s Dirty Little Secrets,” Bank of America analysts argued that Bitcoin “remains exceptionally volatile, making it impractical as a store of wealth or payments mechanism.”

Like Citi, Bank of America also highlighted the cryptocurrency’s environmental impact, noting that its annual energy consumption rivaled that of the Netherlands.

3. Morgan Stanley

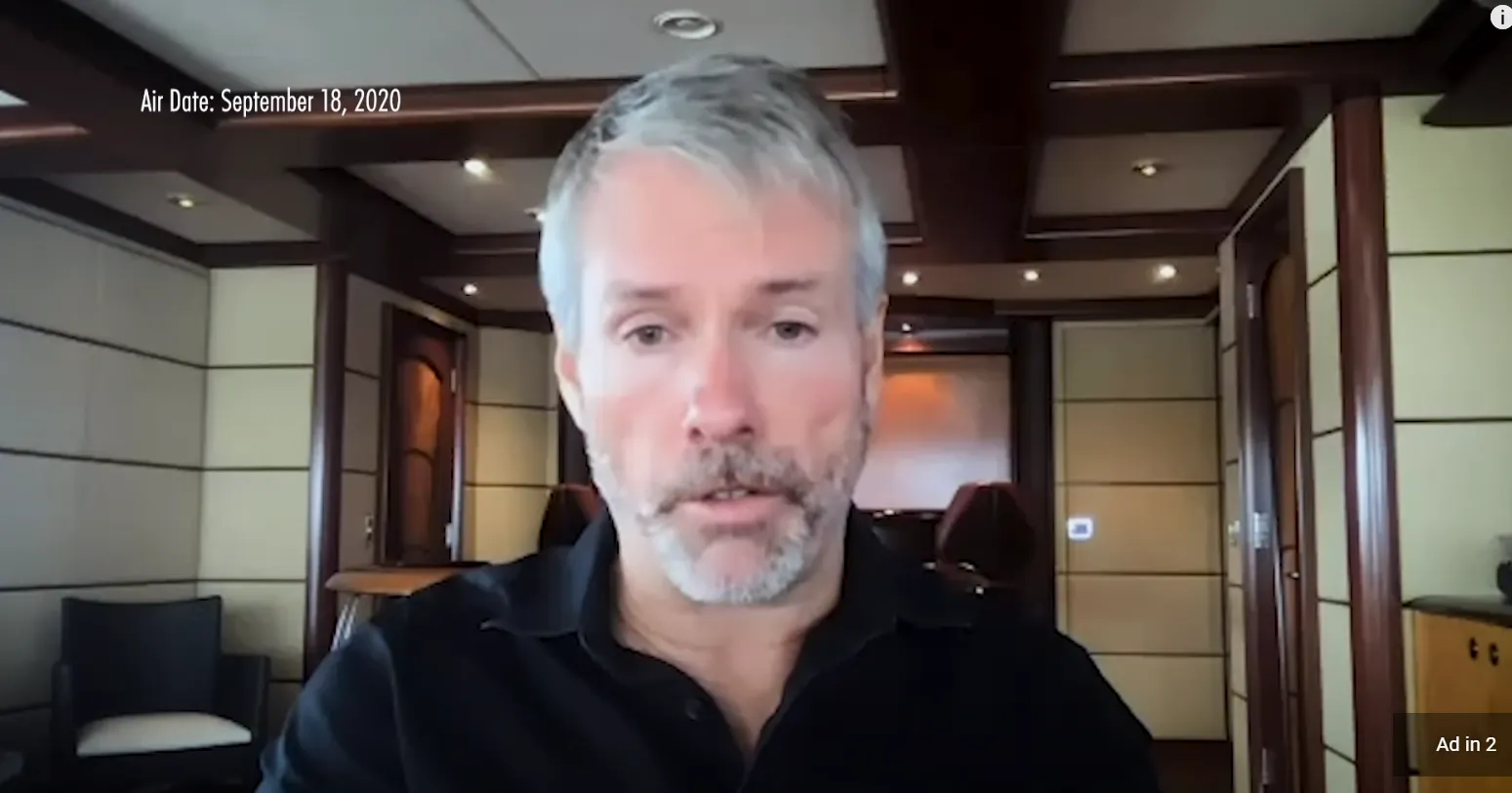

Founded in 1935 and headquartered in New York, Morgan Stanley sent a clear signal in January 2021, when it bought 10% of MicroStrategy—a company whose CEO Michael Saylor is one of the most ardent advocates for Bitcoin.

The bank increased its stake in MicroStrategy by almost 500%—a big vote of confidence for Saylor, whose software company rose to prominence after dropping a quarter of a billion dollars on Bitcoin in August last year.

Then, in March, the bank announced plans to offer its wealthier customers access to Bitcoin funds, with three choices on offer. No surprise, then, that a March 2021 report by the bank asserted that cryptocurrencies are on the threshold of becoming an investable asset class.

4. Commerzbank

While it’s dipped its toes into blockchain, Germany’s second-largest lender hasn’t deemed Bitcoin worthy of a report, having previously described it as a speculative asset, according to the Financial Times.

But actions speak louder than words—The Street reported in March 2021 that Commerzbank’s venture arm had participated in funding rounds for Curv, an Israeli startup that specializes in cryptocurrency. Curv was subsequently acquired by PayPal, which last year announced that it would integrate cryptocurrencies.

5. Goldman Sachs

New York-headquartered Goldman Sachs, one of the oldest banking firms, is due to open a trading desk for cryptocurrencies this month—for Bitcoin futures, specifically, according to reports.

But, in fact, the venerable firm first announced plans for a crypto trading desk back in 2018 and then quietly shelved the idea amid the Bitcoin price slump later that year. By 2020, it had completely changed its tune and even denied that Bitcoin was an asset class, warning against hedge funds trading cryptocurrencies, and citing a lack of serious investment rationale.

It appears that Goldman execs began to reconsider its position (again) in the summer of 2020 when the bank advertised for a VP of Digital Assets. Goldman Sachs is also indirectly exposed to Bitcoin through its shareholdings in Tesla (as is JP Morgan Chase), and its plans to offer crypto custody are also reportedly imminent.

6. JP Morgan Chase

One of the largest investment banks, JPM Chase has gone full circle in its views on the world’s most popular cryptocurrency. In 2017, CEO Jamie Dimon labeled Bitcoin a “fraud,” and even said he would fire any JP Morgan trader caught dealing in it. But over the years the bank’s view seems to have softened, and a January 2021 research note even projected that Bitcoin will rise to $146,000.

In December 2020, JP Morgan Chase strategists suggested that insurance companies and pension funds around the world could invest $600 billion in Bitcoin, following the example of MassMutual.

7. BNY Mellon

Bank of New York Mellon, one of America’s oldest banks, didn’t have the smoothest start with cryptocurrencies. In 2016, it reportedly wired over a hundred million dollars to an account linked with alleged crypto Ponzi scheme OneCoin, according to reports that emerged last year.

Announcing the creation of the BNY Mellon Digital Assets unit - A team dedicated to building the first multi-asset custody and administration platform for traditional and digital assets, including #cryptocurrencies. https://t.co/aZ7wMfAXqg pic.twitter.com/L54TFVpJNv

— BNY Mellon (@BNYMellon) February 11, 2021

But, in February 2021, BNY Mellon—which controls around $2 trillion—made a bold move when it announced plans to store and manage Bitcoin, and other digital assets on behalf of its clients.

“When the world’s largest custodian announces that it will provide custody services for digital assets—that feels like a tipping point in the market,” Guy Hirsch, US Managing Director at eToro, told Decrypt at the time.