"Celsius’s problems did not start in 2022," read today's examiner's report on the now-bankrupt crypto lender. "Rather, serious problems dated back to at least 2020, after Celsius started using customer assets to fund operational expenses and rewards."

The final examiner’s report for Celsius’s bankruptcy proceedings paints a detailed account of the crypto lender’s finances and actions in the lead-up to its insolvency.

Celsius filed for Chapter 11 bankruptcy protection in July 2022 after it had frozen customer withdrawals and swaps in June due to “extreme market conditions” brought about by the collapse of Terra.

The examiner’s report, however, alleges that Celsius had massive holes in its balance sheet as early as 2020—managing to lose money during the market’s “up only” cycle.

But how exactly did that happen?

Celsius’s borrow-to-lend-to-borrow death spiral

Celsius was never a profitable company, according to the report.

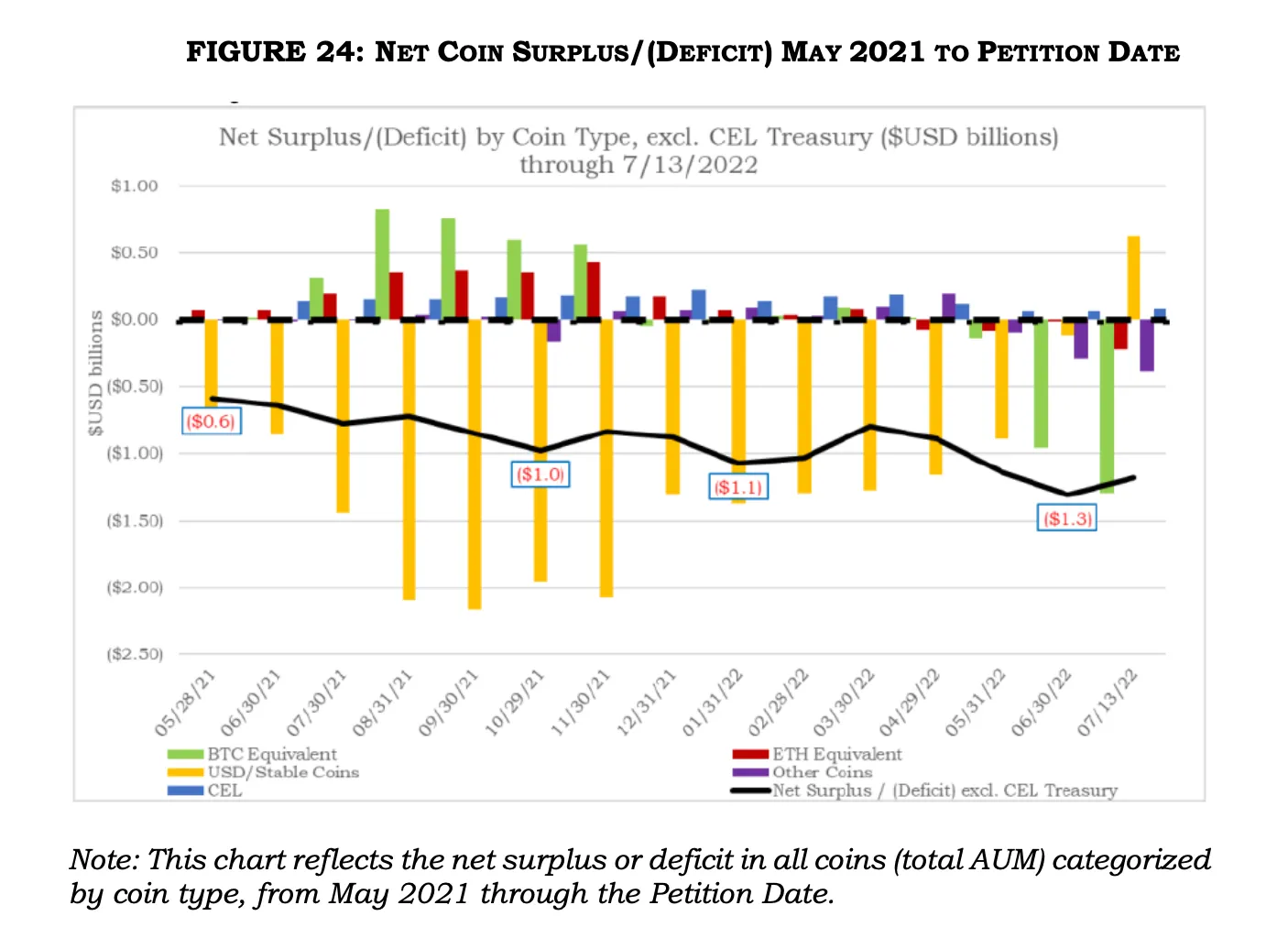

In fact, by the time the company started tracking its assets and liabilities on a coin-by-coin basis in May 2021, it was already $600 million in the red.

The chart below shows Celsius’s stablecoin liabilities hitting more than $2 billion during the peak of the bull market before abruptly being replaced by a hefty Bitcoin and Ethereum deficit by May 2022.

Celsius was allegedly using customers’ deposited BTC and ETH as collateral to borrow stablecoins at a time when crypto prices were high to fund its operations, investments, and customer rewards, alleges the report.

The report said that Celsius’ former vice president of treasury Jason Perman called selling customer assets to cover liability on its balance sheet a “cardinal sin,” and that it was forbidden during his tenure. Still, employees could cover shortfalls using loans collateralized by customer assets.

Throughout 2020 and 2021, Celsius took out several loans using BTC and ETH that its customers deposited.

The report also alleges that in 2021, Celsius learned that it would not be able to recover the BTC and ETH collateral used to take out two loans from institutional investment firm Equities First in 2019 and 2020—ultimately losing approximately $288 million on a roughly $129 million loan.

Since this collateral was in fact customer assets, Celsius had to purchase BTC and ETH with the stablecoins it borrowed at significantly higher prices to cover the shortfall.

By 2022, when the crypto market was declining, Celsius “expended BTC and ETH to repay outstanding stablecoin loans and unwind DeFi positions, to in turn obtain more BTC and ETH that it could deliver to withdrawing customers.”

Why was a lender borrowing in the first place?

One reason why Celsius consistently held a deficit was the fact that the interest rate Celsius offered users for borrowing their assets was not correlated with the yield from investing those assets.

The report states that “Celsius consistently set its reward rates based on what it perceived was necessary to beat the competition and not based upon the yield it was earning from investing customer assets.”

And because of this discrepancy, Celsius had to make riskier investments, such as staking assets on DeFi protocols, purchasing the DeFi company KeyFi, supplying liquidity to exchanges, and loaning itself just over $600 million to set up a BTC mining operation.

In terms of Celsius' next play, the crypto lender is reportedly mulling the launch of a new token to help it raise funds and repay its long list of creditors.