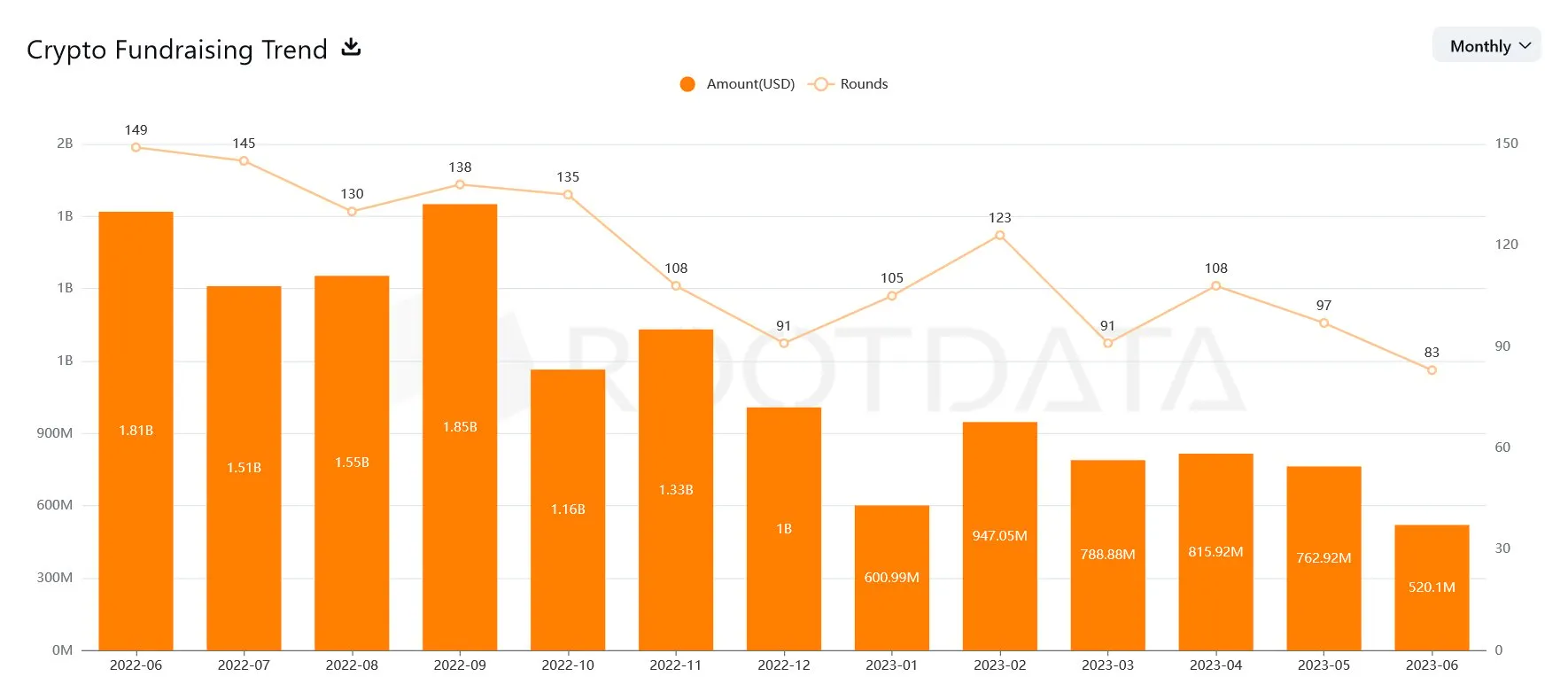

Venture capital investments in cryptocurrency companies have plummeted over 70% over the past 365 days, according to information published by RootData, a crypto data provider. During the month of June 2022, the digital asset space received $1.81 billion in 149 rounds, whereas this year, only 83 projects registered $520 million—the lowest funded month to date.

The RootData numbers show a clear downtrend for VC’s interested in the digital asset space, despite several in-between months that managed increases. September 2022 was the highest on record, for example, with $1.85 billion in funding, investing in a second-best 138 rounds. And June last year had the most recipients, with 149 rounds.

According to the data platform, the infrastructure category leads the way, with $213 million in funding last month for 26 projects. This still represents a nearly 50% drop from the previous month, in which 28 projects received $410 million.

Gensyn AI, a UK based startup was the category’s winner, with a whopping $43 million in a Series A round led by a16z crypto.

CeFi, or centralized finance—which features companies like OPNX and Chiliz—is the second most funded category, receiving $101 million, generating nearly 20% of all financing. Games slid in at third, with $62 million, more than half of which flowed into Mythical Games, which raised $37 million in its Series C1. DeFi and NFT’s round off the list of categories, in that order.

Over the past year, Ethereum had 1,826 projects funded, followed from afar by Polygon (MATIC), with 1,076 funding rounds. Separated by location, the United States received 34% of funding—the most by any single nation on their list–although that appears ripe for a change.

The platform names Coinbase Ventures as the most active VC, having participated in 71 rounds this past year, followed by Hashkey Capital and Shima Capital, funding 54 and 49 projects respectively.

The former high flying crypto asset class has taken a back seat to other investments–namely artificial intelligence.

In a previous interview with Decrypt, Mysten Labs co-founder and CEO Evan Cheng said this shift is due to the ability of AI products and applications to cater to a broader audience while the crypto industry continues to focus on itself.

Cheng considers AI, however, to be complementary with Web3—Justin Sun’s newly launched $100 million AI development fund is one such example.

Diminished interest from venture capitalists in the crypto asset space could be due to a variety of other reasons as well. The dismal actions by companies such as FTX and Terra might be to blame, along with the banking turmoil that took down all four of the “crypto friendly banks.” Adding to the mix is the recent regulatory clampdown occurring in the United States, the country that has nonetheless led the way for crypto investments.