In brief

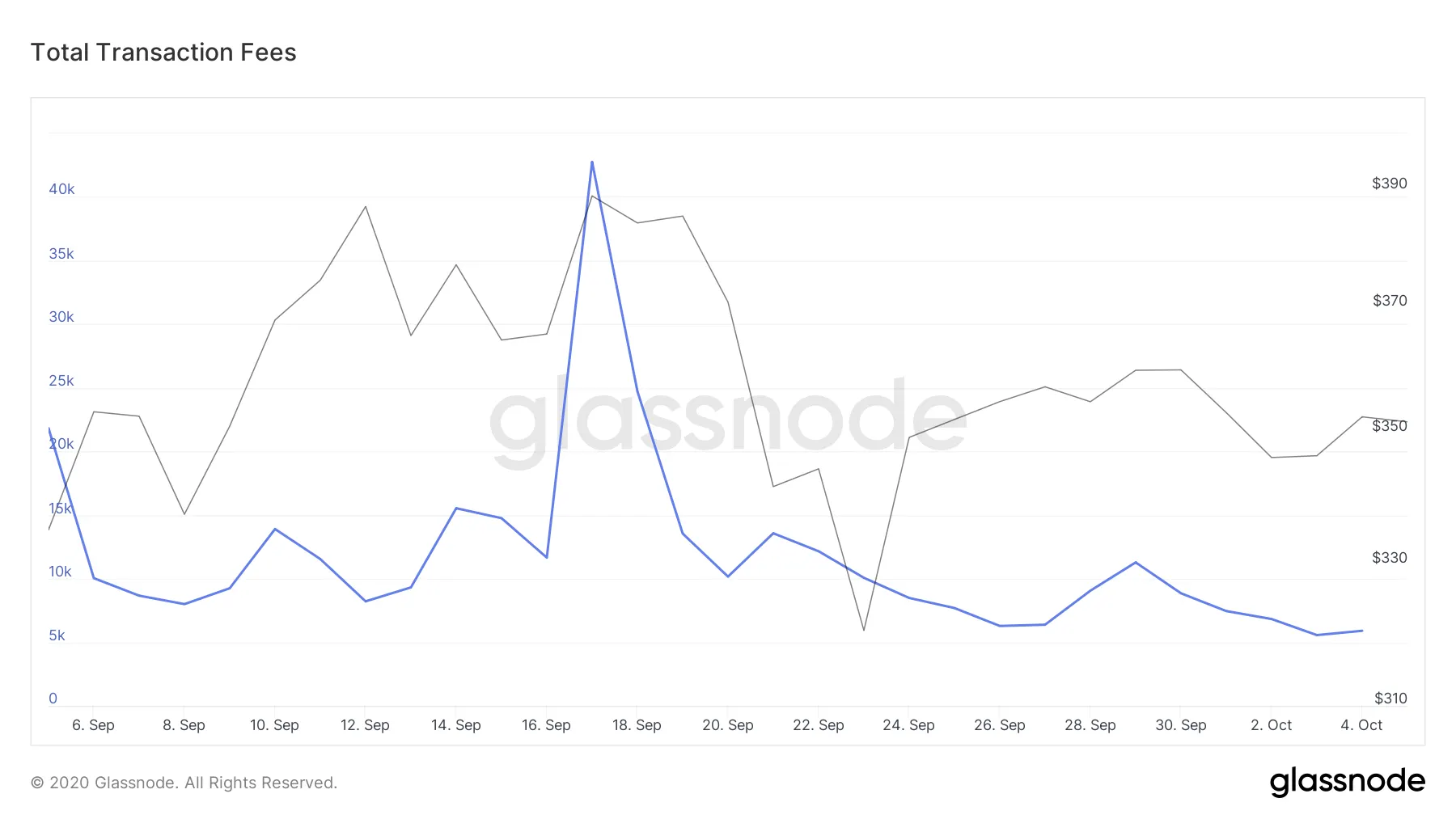

- Transaction fees earned by Ethereum miners have fallen by more than 85% in under three weeks.

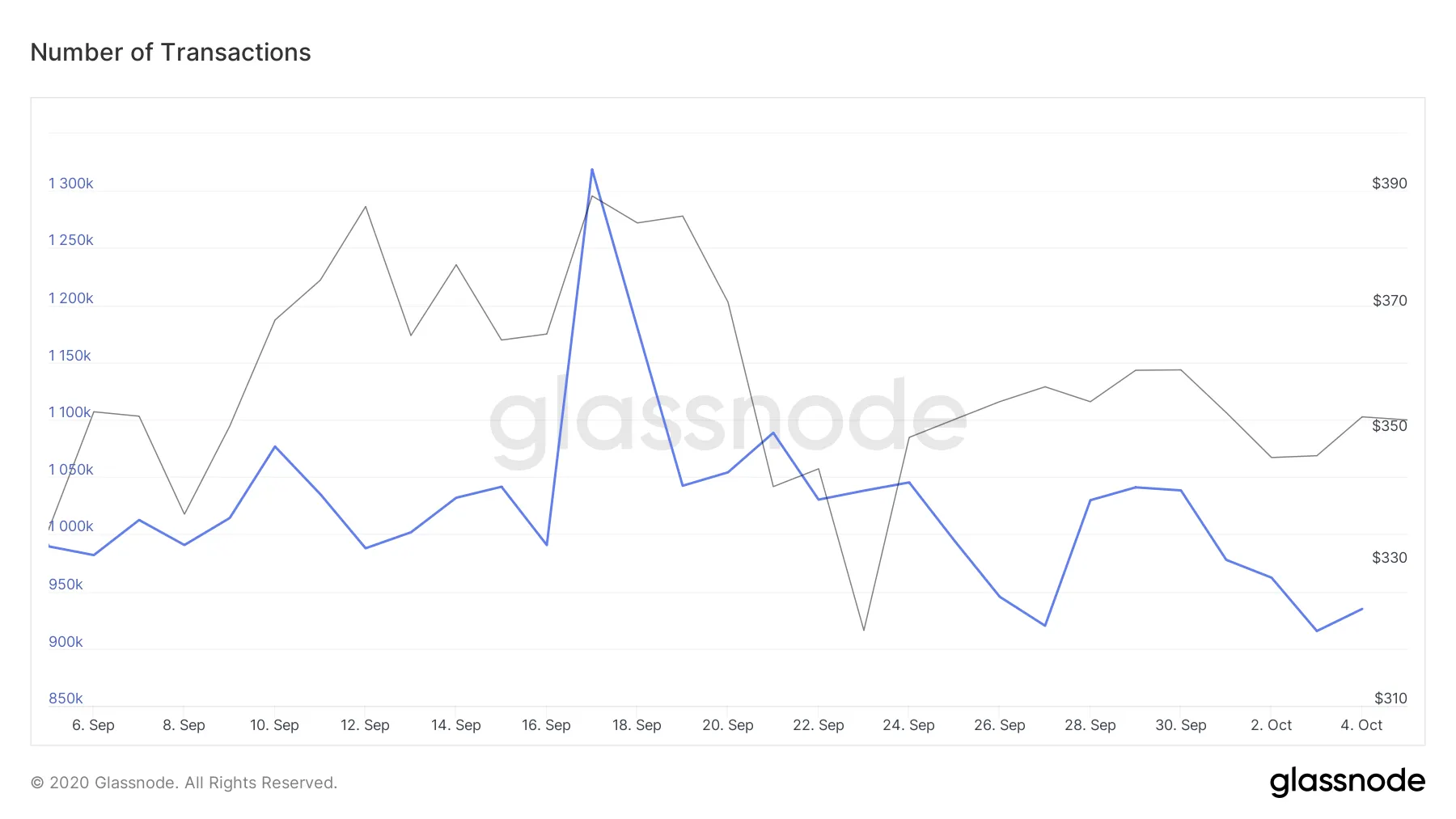

- A smaller decrease has been observed in the total number of Ethereum transactions.

- The total number of ETH sent has also dropped by 74%.

The average Ethereum (ETH) transaction fee reached an all-time high (ATH) of almost $12 last month, causing a major pain point for traders and other ETH users. As a result, Ethereum miners have been racking up record fees, earning a total of $166 million from transaction fees alone in September.

But now, things have largely returned to normal. According to data from Glassnode, the total Ethereum transaction fees earned by miners have fallen from a peak of 42,763 ETH on September 17, down to 5,898 yesterday—equivalent to a decline of 86.2% in under three weeks.

In turn, the average fee per transaction has fallen by a similar degree, and has dropped from a September 17 peak of $11.62, down to $2.1 as of yesterday. This makes the Ethereum blockchain cheaper to use.

It isn't just transaction fees that have fallen dramatically in the last few weeks. The absolute number of transactions on the Ethereum network has also fallen considerably to reach 935,000 yesterday—down 29.2% since reaching a 2020-peak of 1.32 million on September 17.

The total value transacted has fallen by an even greater degree. It has dropped from 6.5 million ETH on September 17, down to 1.7 million ETH yesterday—a decline of 74%.

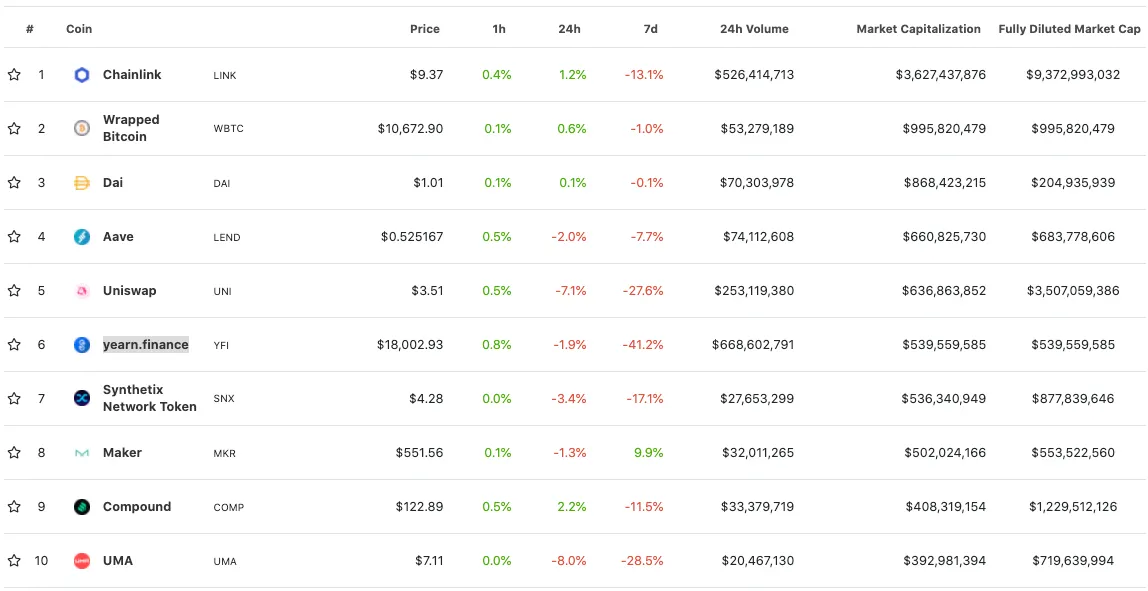

The fee hikes seen between June and September were largely owed to the rapidly expanding interest in the decentralized finance (DeFi) industry, which saw platforms like Uniswap, Curve, Aave, and various yield-farming projects like YAM, draw significant attention. Since the Ethereum network is only capable of processing a limited number of transactions in each block, and can only handle around 10-14 transactions per second, competition for block space increased dramatically leading to a gas war among those that needed their transaction to be confirmed quickly.

Did you know?

A similar fee hike was observed on the Bitcoin (BTC) blockchain in December 2017, driving the average BTC transaction fee up to over $50 at its peak.

Now, the hype around DeFi projects has died down somewhat and most major DeFi coins are in shattering losses in the last week, including Uniswap (-27.6%), Yearn Finance (-41.2%), and UMA (-28.5%). This should give Ethereum some much-needed breathing room.