In brief

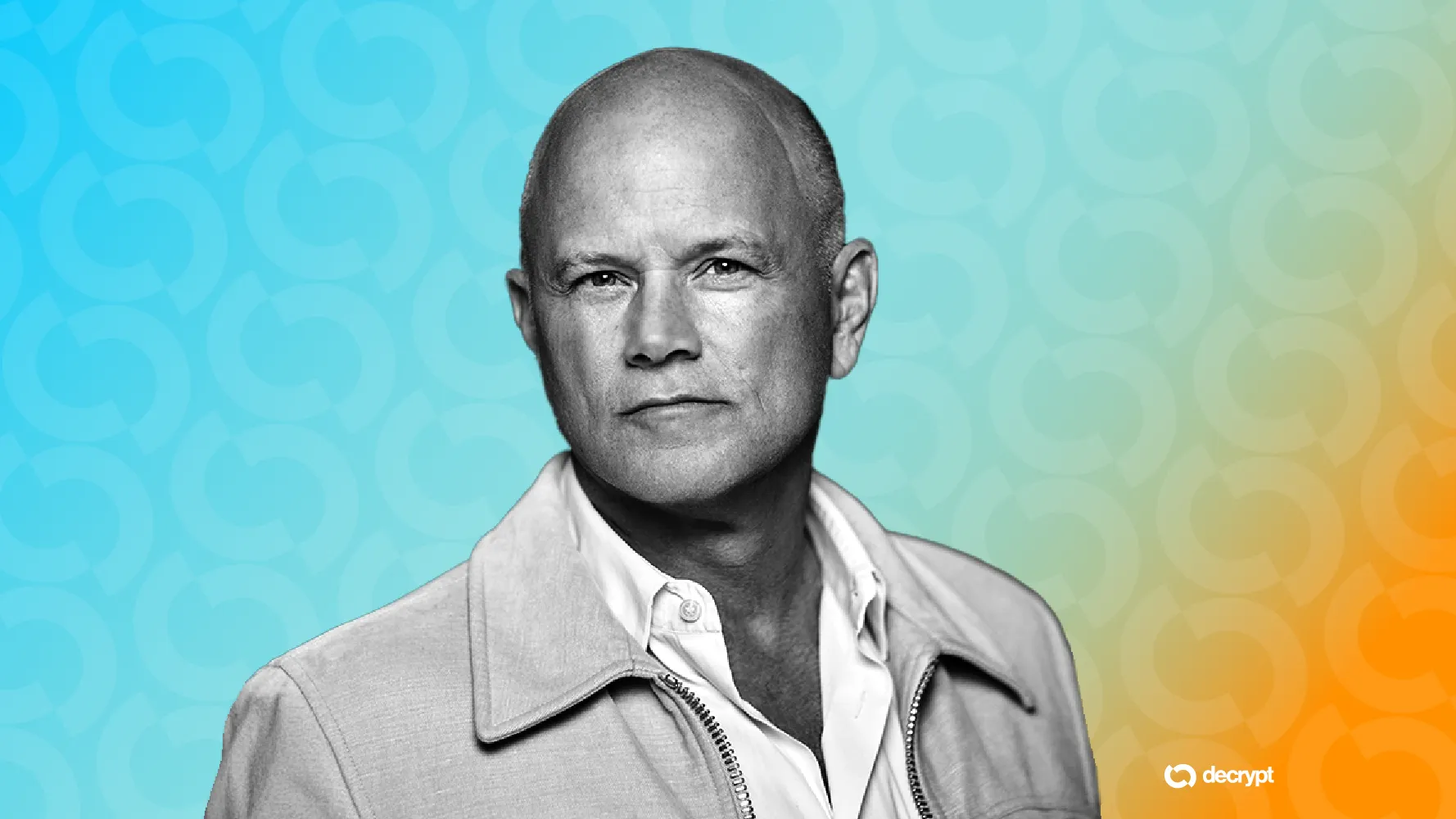

- Galaxy CEO Mike Novogratz said that Ethereum could do better than Bitcoin over the next three to six months.

- Institutions buying the second-biggest cryptocurrency will help propel its rise, he said.

- ETH remains well below its all-time high mark from 2021, while Bitcoin just recently hit another fresh peak.

Crypto entrepreneur and billionaire Mike Novogratz thinks that Ethereum has the ability to outperform Bitcoin over the next few months.

During a Thursday interview with CNBC, the CEO of digital assets infrastructure company Galaxy said that institutional interest could push the second-biggest cryptocurrency higher after a recent surge.

Ethereum—or ETH—was recently trading at nearly $3,730 per coin, according to crypto data provider CoinGecko, after hitting a 2025 record of $3,848 on Monday. The coin is still 24% below its all-time high of $4,878 that it hit in 2021, but has made a comeback.

"I think Ethereum probably has a lot of chance to outperform Bitcoin in the next three to six months," said Novogratz. "The narrative of ETH is really powerful."

"ETH has caught up a lot," he continued, adding that the virtual coin could hit $4,000 soon.

Myriad users currently believe that Ethereum will set a new all-time high price by the end of 2025, with 55% of predictors expecting the coin to beat the current high mark. (Disclosure: Myriad is a product of Decrypt's parent company, DASTAN.)

Novogratz said that big companies buying the asset was helping propel its rise. Publicly traded companies are copying the Bitcoin treasury model from publicly traded firm Strategy (formerly MicroStrategy)—but instead of BTC, they're buying ETH.

Nasdaq-listed miner BitMine Immersion has aggressively snapped up over the cryptocurrency and now has $2 billion worth of ETH, making it the current leader in that space. And the Nasdaq-listed SharpLink Gaming has also bought over $1.3 billion in the asset since committing to the treasury strategy in May.

American investors are also fast piling into ETH exchange-traded funds: The products—approved by the SEC last year—received over $726 million in net inflows in one day last week, the best 24 hours in their trading history. The funds collectively added more than $2.1 billion over the course of last week.

Novogratz added that Bitcoin, the biggest cryptocurrency, could hit $150,000 per coin this year. The leading digital coin was recently trading for $118,628 per coin, down slightly over the past week but up nearly 12% over a 30-day period. Bitcoin recently set a new all-time high mark of $122,838.