Toncoin (TON) is no longer one of the top 10 most valuable cryptocurrencies in the world, following an update from The Open Network to more accurately reflect the asset’s circulating supply via price trackers.

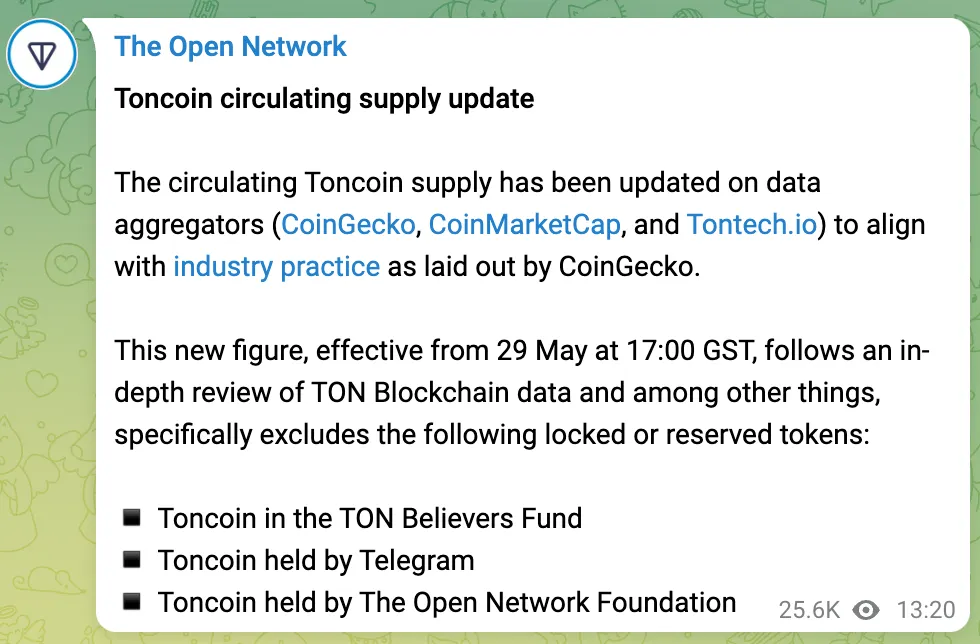

In a Telegram message on Wednesday, the project informed users that data aggregators would track the coin’s market capitalization differently moving forward. They would exclude Toncoin held by Telegram, The Open Network Foundation, and the TON Believers Fund, it stated.

As the change went effective, Toncoin’s market capitalization dropped more than $7 billion instantaneously, according to CoinGecko data. Meanwhile, the cryptocurrency Cardano (ADA) reclaimed its spot as the 10th most valuable cryptocurrency, currently valued at $15.8 billion. TON, as of this writing, isn't far behind at about $15.6 billion.

The data reported by CoinGecko can be linked to tontech.io, among other stats. In its message, The Open Network said the update to TON’s circulating supply was made to align with “industry practice” and followed an in-depth review of the TON blockchain’s data.

As of this writing, it was unclear what entity manages tontech.io. However, the page does include a link directing users to ton.org, where the community responsible for TON is broken down into the TON Foundation, TON Society, and several other subgroups.

After TON flipped ADA earlier this week, members of the Cardano community questioned how TON could retain its price following its sizable drop in market cap. Chris O’Connor, co-founder of the DAO Cardano Ghost Fund, then claimed on Twitter (aka X) that The Open Network had been “caught red handed [while] artificially pumping” its market capitalization.

The Open Network did not immediately respond to a request for comment from Decrypt.

As competing layer-1 ecosystems, the tension between TON and ADA captures how projects value their portrayal by data aggregators, including CoinMarketCap. Amid 14,500 coins tracked by CoinGecko, for example, a top-ten spot is highly coveted.

The U.S. Securities and Exchange Commission brought charges against Telegram in 2020 over the Telegram Open Network. The regulator accused the messaging app of violating securities laws by offering the network’s native token “Grams,” securing an $18.5 million civil penalty alongside $1.2 billion in funds returned to investors.

The Open Network today is built using technology designed by Telegram, though the project was ultimately continued by the external community of developers after Telegram abandoned it in 2020.

However, Telegram has more openly embraced TON over the past several months. Last September, the messaging platform said it had adopted TON as its “official Web3 infrastructure.” That same month, the TON Foundation announced its registration as a Swiss non-profit organization. Lately, Telegram has started using TON to share channel ad revenue with users.

Over the past year, TON’s price has skyrocketed more than 240% to $6.49. And the asset’s price has been bolstered recently by the popularity of Notcoin (NOT), a Telegram-based game and cryptocurrency where users were rewarded for repeatedly tapping a digital gold coin.

Edited by Andrew Hayward

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.