Stacks sees uptick in activity

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$65,540.00

3.84%$1,913.04

4.93%$1.38

3.65%$601.65

2.26%$0.999902

0.00%$82.41

7.69%$0.286528

2.16%$1.034

0.24%$0.093418

2.61%$48.89

3.17%$0.269889

5.02%$0.999885

-0.01%$492.13

1.92%$8.68

10.03%$26.86

1.49%$336.52

5.91%$0.162137

0.55%$0.999789

0.11%$8.57

5.14%$0.154446

3.49%$0.999445

0.06%$0.00940192

1.89%$0.09801

5.49%$0.999882

-0.01%$52.88

3.98%$240.70

3.89%$8.69

5.04%$0.00000601

1.48%$0.892157

4.10%$1.30

-1.41%$0.114448

7.07%$0.075639

2.16%$5,172.78

0.48%$1.44

2.21%$5,208.12

0.37%$3.55

6.72%$1.30

4.67%$0.601572

3.28%$1.00

0.00%$118.02

4.57%$0.997412

0.01%$0.699223

0.93%$176.62

6.08%$0.000004

2.66%$0.999947

0.02%$1.12

0.00%$75.57

3.50%$1.00

0.01%$2.22

0.98%$0.16546

2.43%$0.066444

5.20%$0.00000165

0.81%$0.999432

0.02%$8.47

3.73%$1.013

3.95%$0.257118

5.39%$0.114428

8.51%$2.19

7.14%$11.00

0.03%$0.403257

9.87%$6.92

3.93%$8.55

4.55%$0.00176396

0.60%$2.05

0.09%$0.057319

-0.86%$65.39

3.84%$0.01689224

-3.52%$0.101711

7.44%$0.999575

-0.09%$0.832611

2.33%$3.43

5.54%$1.23

0.00%$0.0093434

4.41%$0.02945742

0.29%$0.777966

-3.19%$0.086102

3.64%$114.40

0.01%$0.99996

0.05%$1.41

4.78%$1.027

0.01%$1.11

-0.16%$0.915759

4.68%$0.858254

6.50%$0.0333356

-0.75%$1.80

16.09%$0.00729031

2.04%$0.080193

0.20%$1.095

0.01%$0.996007

-0.06%$0.093773

3.01%$1.00

0.04%$0.00000595

3.37%$0.02870143

-1.58%$0.01294728

-0.33%$0.999479

0.04%$27.93

3.80%$0.148866

5.01%$1.087

-0.03%$0.259838

10.14%$0.715475

23.23%$0.999941

0.03%$1.18

-0.03%$0.249723

8.08%$0.067905

4.20%$33.94

7.65%$0.00676375

7.72%$1.27

6.13%$0.04598743

1.12%$0.375457

2.21%$166.43

-0.25%$1.00

0.10%$0.508402

14.23%$1.029

2.54%$0.241921

11.03%$0.156926

3.46%$0.080367

4.26%$0.0340471

0.61%$1.39

1.42%$1.019

-0.08%$0.999742

-0.00%$0.00000033

0.54%$0.00000033

1.45%$123.43

4.01%$0.054762

4.46%$3.20

0.23%$16.00

7.80%$0.01655139

1.05%$3.20

2.21%$0.330886

8.38%$1.49

-0.21%$0.052276

5.67%$0.067907

4.09%$0.995308

-0.32%$0.00577605

4.31%$0.02649939

3.47%$0.29985

9.66%$0.315735

7.33%$0.00002883

4.08%$0.989793

-0.31%$0.373551

25.96%$17.18

1.64%$0.228557

16.25%$1.61

-1.78%$0.306231

4.40%$0.074996

12.94%$0.04990924

4.04%$1.38

1.84%$0.137357

4.10%$0.117824

1.26%$0.00247907

0.52%$0.00256092

2.48%$6.17

4.18%$0.999093

-0.04%$0.04183183

4.12%$0.999996

-0.00%$1.30

8.00%$0.02020219

0.58%$1.75

4.15%$0.988398

0.01%$1.075

0.01%$0.999877

0.05%$0.081012

4.45%$0.511281

3.82%$1.27

7.91%$22.79

0.00%$0.00211374

3.43%$0.099429

2.00%$0.00000095

-0.14%$5,265.96

1.94%$0.088446

3.80%$0.202222

8.03%$0.197886

-0.23%$0.00003553

1.88%$0.052847

2.86%$1.00

0.00%$2.66

1.51%$0.01999706

6.97%$0.183702

-0.02%$9.28

9.39%$0.077754

1.31%$0.180482

21.37%$0.120558

5.56%$1.00

0.00%$0.092566

3.12%$0.00480534

3.48%$18.13

6.83%$3.95

17.14%$0.02392752

0.68%$0.769517

1.01%$1.00

-0.02%$1.83

6.20%$0.00354233

2.73%$2.08

2.37%$0.0201985

-0.80%$1.79

0.11%$0.605685

4.11%$47.99

-0.00%$0.051796

5.14%$3.44

4.38%$2.03

6.86%$0.995667

0.11%$1.26

0.60%$0.156475

11.04%$0.00000762

2.99%$0.03996884

2.97%$0.998347

0.06%$0.998981

-0.19%$0.14947

0.11%$0.710331

14.22%$1.014

0.07%$0.165638

8.45%$0.314009

0.33%$0.303787

-0.58%$0.39988

4.63%$0.649741

4.63%$0.07591

3.57%$0.616718

7.48%$0.02319478

-10.49%$0.080785

5.30%$1,097.76

0.03%$4.43

4.88%$0.319745

0.46%$0.294087

5.02%$0.256832

2.44%$0.128161

4.16%$0.090753

4.90%$1.93

5.00%$0.125266

-4.11%$0.362278

6.41%$0.130666

-0.13%$0.251516

4.57%$0.220706

0.47%$0.0014584

1.43%$0.122895

29.26%$8.08

-6.80%$0.995461

0.08%$0.075624

5.30%$0.00394295

2.66%$1.001

0.00%$0.118791

-0.52%$0.99967

0.02%$0.987785

-1.63%$2.35

5.57%$0.194518

7.87%$9.79

-18.19%$1.44

-1.87%$1.062

0.00%$1.00

0.06%

STX, the native token powering the Bitcoin-adjacent Stacks blockchain, has gained 19% overnight, according to data from CoinGecko.

At press time, STX is changing hands at roughly $0.70, slightly lower from its 180-day high of $0.75, reached earlier today.

On a weekly note, STX is up a whopping 132%. The weekly gains not only handed hefty profits to short-term holders but also helped the coin regain its billion-dollar market capitalization.

Despite the week’s positive rally, STX is still down 78% from its historical all-time high of $3.39 in December 2021.

Launched in 2017, Stacks is built on top of Bitcoin, allowing developers to build and deploy smart contracts secured by the original blockchain network.

In simpler terms, Stacks operates much like Ethereum with a link to the Bitcoin blockchain through proof-of-transfer (PoX) consensus. According to Stacks, “PoX uses the proof of work cryptocurrency of an established blockchain to secure a new blockchain.”

A likely driver behind the recent pump in STX may have been the steady growth of NFT network activity on the Stacks blockchain.

The hype around Ordinals, a newly launched Bitcoin-based NFT project, may have also had a positive impact on the network’s overall activity as investors hunt down more exposure to the NFTs-on-Bitcoin narrative.

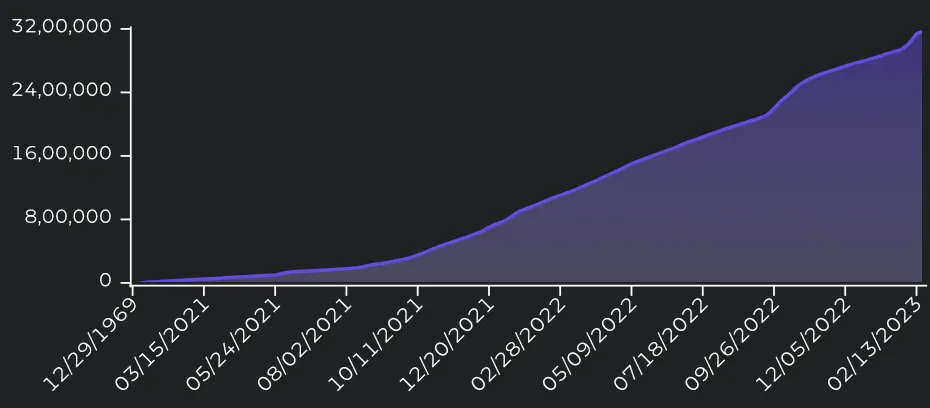

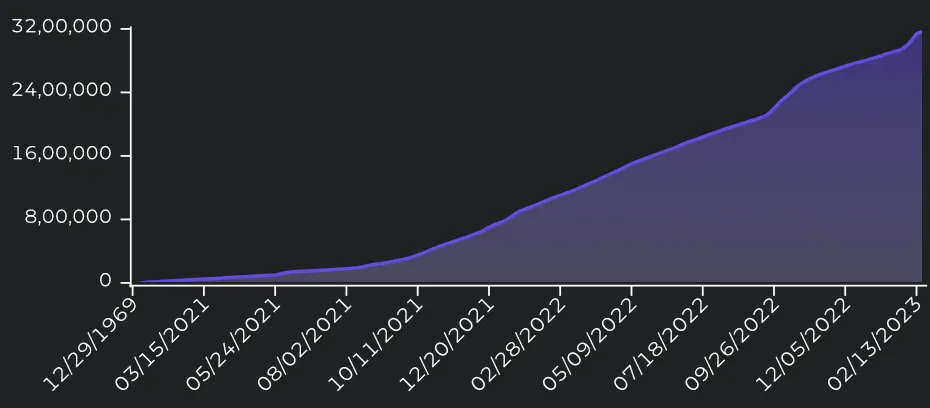

Per data from Stacks on Chain, in February, with a week to go, the network has processed 3.36 million transactions, a 223% surge compared to the network’s 1.13 million transactions last month.

During the same period, there was a clear spike in the number of transactions on the Stacks network’s mempool, indicating increasing network demand per data from Stacks on Chain.

Mempool is a pending transaction queue where new blockchain transactions are stored before being validated and added to the blockchain.

As for Bitcoin, the largest cryptocurrency by market capitalization has dropped 0.1% over the past 24 hours but has risen a whopping 13.5% over the week.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.