There are two primary parties involved in a staking transaction. A staking delegator entrusts—or delegates—their tokens with a validator in order to earn staking rewards. A validator is generally incentivized to accept a delegator’s tokens in order to increase their staking allotment as they typically earn a percentage of the gross staking rewards.

With Figment and other non-custodial staking options, you can essentially be both parties in the arrangement; you function as both the delegator and validator. In this instance, you are particularly incentivized to participate in proof-of-stake (PoS) blockchain protocols, as you accrue the associated staking rewards in their entirety.

Figment and liquid staking

In addition to its easy-to-set-up staking validator nodes, Figment also offers a token that automatically earns staking rewards. Before we explain Figment’s specific liquid staking option, it’s worth explaining the concept in general. Liquid staking tokens (LSTs) are typically a token that acquires staking rewards through a novel process. These LSTs are 1:1 representational derivatives of the original staked asset. For example, if you staked 2.5 ether (ETH), you’d receive 2.5 LSTs equivalent of ETH.

While there are several benefits to LSTs (no staking minimums, no need to run a validator node), one of the primary benefits is that you can access the liquidity of your LSTs to use them for other processes—while still accruing staking rewards. For example, you can use LSTs as collateral for borrowing; you can also deposit them on lending platforms in order to earn additional yield.

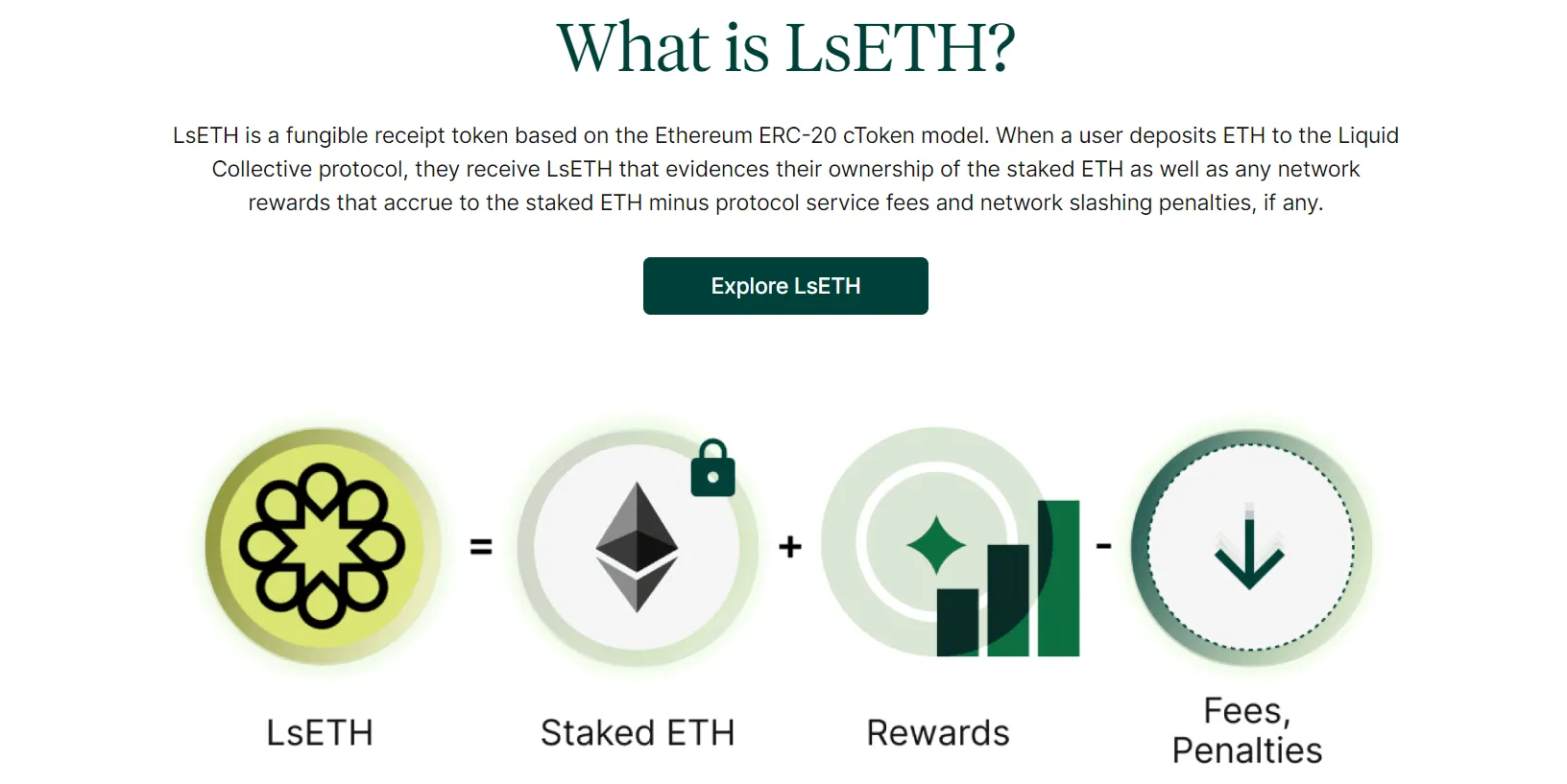

Figment is partnered with Liquid Collective, a Web3 organization that offers Liquid staked ETH (LsETH). Upon depositing ETH, you will receive LsETH that proves ownership of your deposited ETH and any associated staking rewards (minus protocol fees and funds lost in any potential slashing events). Targeted as an institutional LST investing option, LsETH intends to provide ample liquidity and robust security through a network of trusted validators.

Figment’s solutions and the future of staking

In the early years of Bitcoin, retail crypto miners were able to profitably mine BTC via a laptop or a graphics processing unit (GPU) repurposed to mine crypto. Since then, the crypto mining industry has largely become an institution-only affair as the competition to mine profitably now requires large arrays of expensive crypto miners, vast warehouses to house them, and access to cheap electricity.

PoS has maintained a more egalitarian structure as staking can still be carried out profitably at both the retail and institutional level. However, like crypto wallets and crypto custody, institutional staking requirements demand different solutions than those on offer for typical retail crypto stakers. Figment is one such company solving the needs of institutional users that implement crypto staking strategies.

Institutional staking adoption will likely increase as the space matures, institutions become more comfortable with crypto investment, and regulatory clarity becomes more concrete and established on a global level. For those that require institutional-grade solutions, it is likely that this space will continue to develop and refine their staking services to meet the forthcoming demand.

While some expect the institutional segment of the staking ecosystem to increasingly gain market share, we do not currently see any reason to expect that retail staking will become a rarity in the same way that crypto mining has.

Cheat Sheet

- A staker delegates their tokens to a validator to earn staking rewards. A staking validator accepts a delegator’s tokens to earn a percentage of associated staking rewards.

- With Figment and other non-custodial staking solutions, one party can be both the staking delegator and validator.

- Through Liquid Collective, Figment also offers Liquid Staked ETH (LsETH), a liquid staking token programmatically generated when users stake ETH through this Web3 collective protocol, that (unlike Ether) lets users accrue staking rewards while simultaneously allowing these users to access their LsETH liquidity for other processes.

- While some expect institutional staking will gain market share from the retail staking system, it is still likely that, regardless of the growth of institutional staking, retail staking will remain a significant part of the overall staking ecosystem.

Sponsored post by Figment

Learn More about partnering with Decrypt.