In brief

- As the price of Bitcoin rises, its futures market is booming.

- Aggregate open interest and trading volume have reached their highest levels since the March 12 market crash.

- Volume is up across the board, including regulated markets. Bakkt registered record volumes on Monday.

Bitcoin’s recent price surge has been accompanied by explosive volume in its derivatives markets.

According to data from Skew analytics, aggregate open interest across Bitcoin futures markets (or the total value of outstanding trades) is broaching $5 billion, the most since before Bitcoin’s price tumbled during the Black Thursday mid-March crash.

Since open interest reflects the total value of all active derivatives contracts in a given market, high open interest generally denotes healthy investment activity, especially if the underlying asset is rising in price.

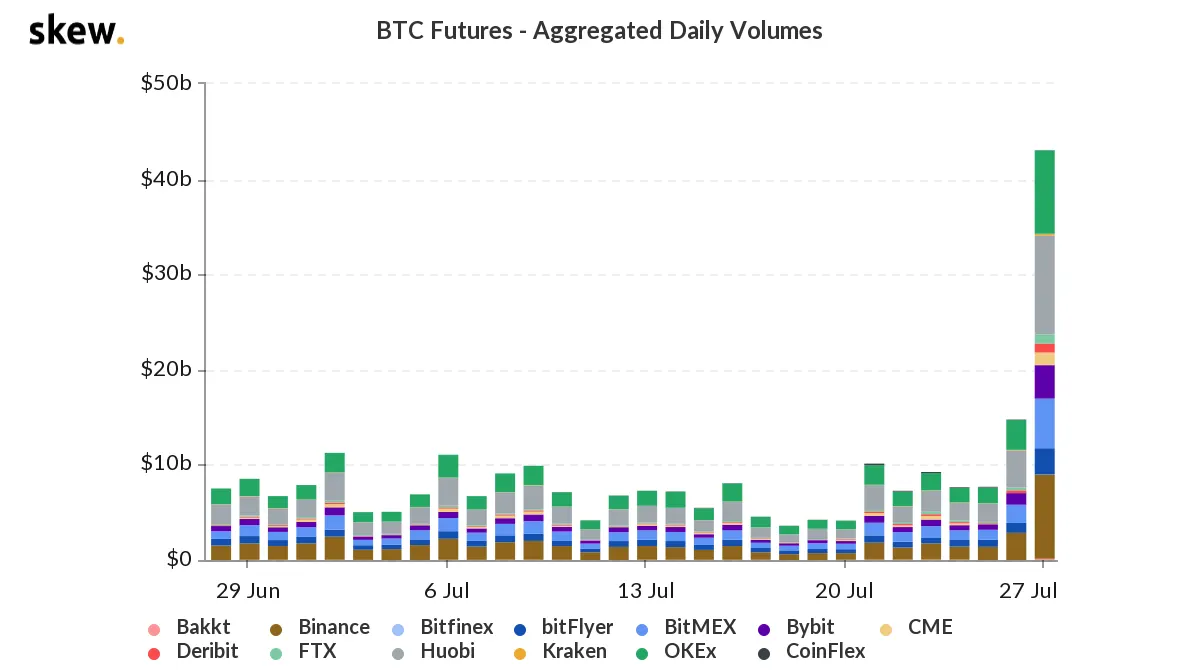

What's more, daily trading volume for Bitcoin futures on Monday, when Bitcoin's price increased 12% to roughly $11,300, hit its second-highest figure ever. Aggregate futures volume across Bitcoin regulated and unregulated futures markets topped $40 billion yesterday.

That’s second only to the $50 billion the futures market recorded on Black Thursday, March 12, the day Bitcoin’s price dumped alongside a macro market selloff that left equities and even precious metals in the red. For context, daily volume on Bitcoin futures markets had not exceeded more than roughly $15 billion in the last 30 days.

This near-record volume reflects the immense buying pressure that has sent Bitcoin above $10,000. Bitcoin’s price rally comes at a time when silver and gold are surging, as well, and one explanation for the rise is that investors are seeking alternative assets to hedge against inflation as central banks continue to ramp up fiscal and monetary responses to economic uncertainty.

As usual, the bulk of this volume comes from unregulated Bitcoin exchanges that offer derivatives products, most notably OKEx, Binance, Huobi and BitMEX. But Bitcoin’s regulated markets are also thriving amidst the run-up.

The CME’s futures market experienced its second-best day on record with $1.3 billion in volume. Bakkt, a relative newcomer which launched at the end of last year, had its best day yet with $122 million in Bitcoin futures volume.

In light of the news that US banks can now custody digital assets, the growing volume in Bitcoin’s institutional-grade markets could be a sign that high-net-worth investors are turning to Bitcoin now more than ever.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.