Metaverse and NFT-focused cryptocurrencies, including Axie Infinity (AXS),Flow (FLOW), Apecoin (APE), and Sandbox (SAND), have posted significant gains over the past 24 hours.

Play-to-earn (P2E) gaming platform Axie Infinity’s AXS governance token soared 25.6% in the last 24 hours, making it the largest gainer among the top 100 cryptocurrencies, per Coingecko.

As of this writing, AXS trades at around $8.54 and is the 46th-largest cryptocurrency boasting a market capitalization just north of $970 million.

Despite today’s heroics, AXS has had a rocky 2022. AXS lost nearly 94.8% of its value from its recorded all-time high of $164.90 in November 2021.

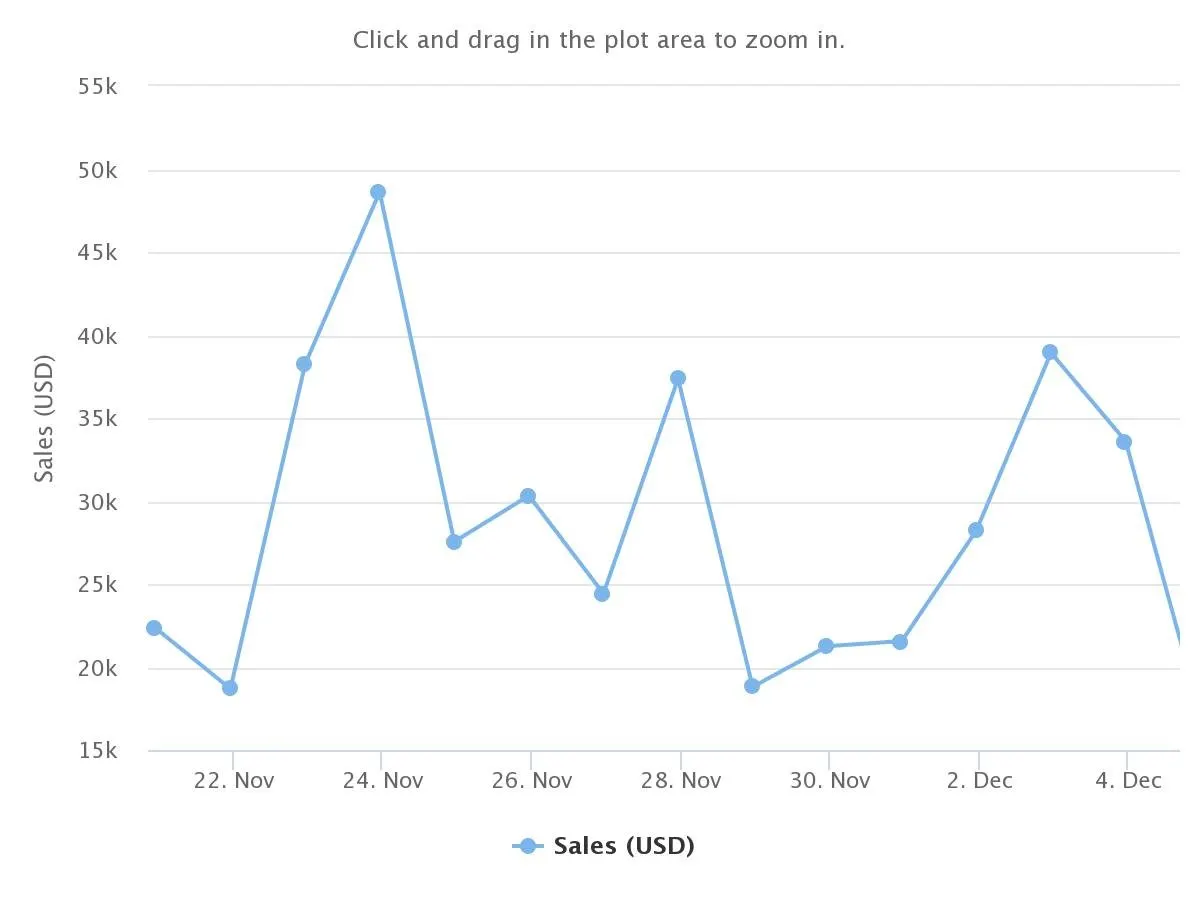

According to NFT data platform CryptoSlam, trading volume for Axie Infinity has fluctuated between roughly $18,000 and as high as $48,000 over the past few weeks.

Given today’s bullish price action, roughly $20,000 in AXS short trades were liquidated in the past 24 hours, according to Coinglass.

Meanwhile, the token powering the Flow blockchain has rallied more than 5.5% over the past 24 hours and trades at around $1.15, per data from Coingecko.

In August 2022, Instagram integrated Flow-based NFTs pumped the token’s price to $3. Since then, however, FLOW has been on a downtrend.

As of this writing, FLOW has lost 97.3% of its value since its all-time high of $42.40 in April 2021.

Apecoin (APE), the Ethereum-based token created for the Bored Ape Yacht Club (BAYC) ecosystem, has also gained nearly 4% over the past 24 hours and trades at around $4.12 per Coingecko.

The 34th-largest cryptocurrency APE’s daily trading volumes rose 66% to $192 million over the past day.

SAND, the token powering the virtual real estate project The Sandbox, is up 6.7% to $0.62 over the past 24 hours, participating in the widely driven NFT-based token rally.

According to Coingecko, SAND gained nearly 9% over the past week. But the bullish week hasn’t been strong enough to reverse its yearly losses. In November 2021, SAND rallied as high as $8.40.

What’s pumping the metaverse?

The primary reason driving the bullish price action of the metaverse and NFT-related tokens is the rising sales volume over the past 24 hours.

According to data from CryptoSlam, overall NFT sales volume rose 20.75% in the last 24 hours to just above $16.5 million.

Ethereum-based, in particular, NFTs saw a 31.36% spike in daily trading volumes, followed by Flow with 16.28%, likely contributing to the token’s latest rally.

Yuga Lab’s NFT collections Otherdeed, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC) collectively made up roughly 40% of the Ethereum-based NFT’s trading volume, helping APE ride its fortunes.

Beyond NFT and metaverse tokens, leading cryptocurrencies in Bitcoin (BTC) and Ethereum (ETH) have also rallied 1.6% and 2.7% over the past 24 hours. The overall cryptocurrency market is also up 2%, amounting to more than $906 billion at press time.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.