Bitcoin will be the only digital asset that trades on American stock exchanges via exchange-traded funds (ETFs), according to the prominent founder of software company MicroStrategy.

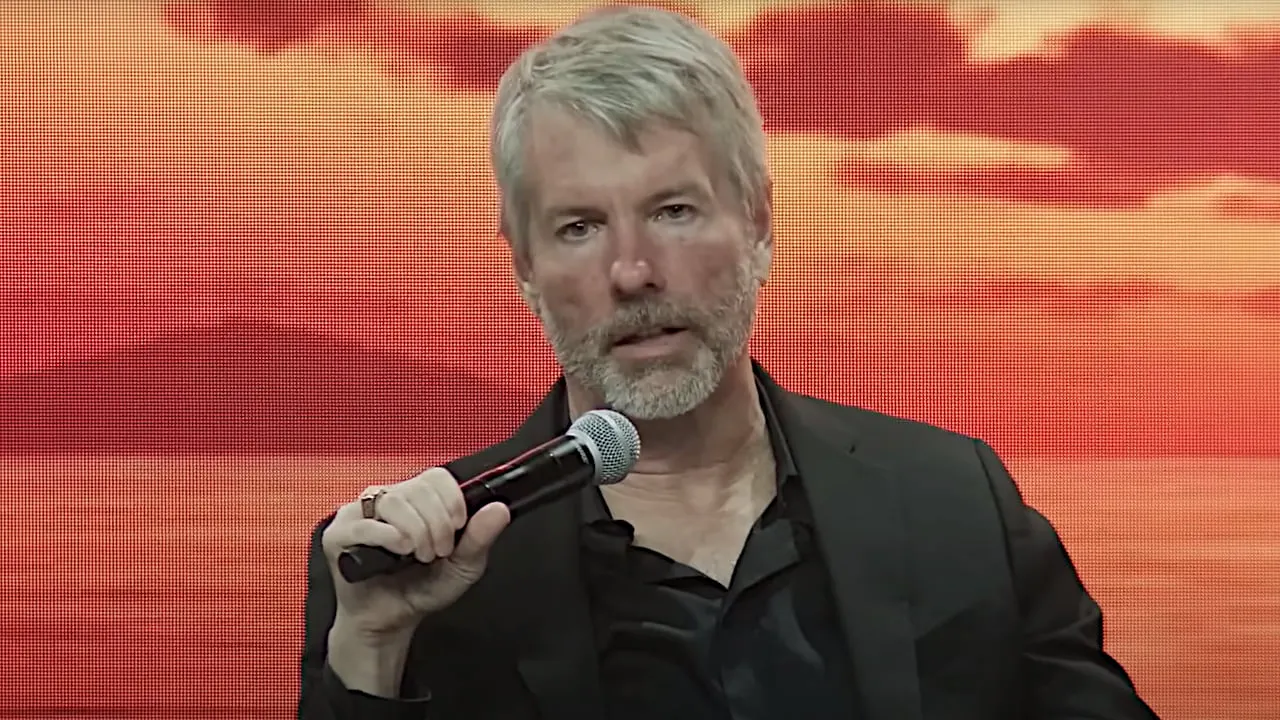

In its quarterly earnings call for 2024, MicroStrategy founder and Executive Chairman Michael Saylor said that “it’s pretty clear that Bitcoin is the only crypto asset that’s going to be approved for sale in the form of a spot ETF in the United States.”

The Securities and Exchange Commission (SEC) gave the green light to 11 spot Bitcoin ETFs in January after 10 years of denying such products. The investment vehicle allows people to buy shares via brokerage accounts that track the underlying price of the cryptocurrency.

Now, a number of high-profile asset managers are hoping to get approval from the SEC for spot Ethereum ETFs. BlackRock, Fidelity, and Grayscale are just some of the big names who have filed paperwork with the Wall Street regulator.

But industry analysts are not bullish about such a product getting approval by the SEC by the May deadline—and even less so now after Ethereum software company Consensys last week sued the SEC, alleging that it considered Ethereum a security.

Saylor said in the earnings call yesterday that Bitcoin is the “one crypto asset that a publicly traded company can hold on its balance sheet, can capitalize upon.”

“It’s the one crypto asset that Wall Street firms are going to be able to sell on a spot ETF basis,” the MicroStrategy executive chairman said.

“The entire modern institutional asset economy, the options market, the securities market, the money manager system, the institutional mutual funds, the institutional ETFs—they’re all going to be centered around Bitcoin as the digital property going forward,” he added.

MicroStrategy, which sells data-analyzing software, has been buying Bitcoin since 2020. It argues that the biggest digital coin by market cap is a good investment and gets better returns for shareholders over cash, which loses purchasing power.

On Monday, the Tyson, Virginia-based company announced that it had bought more Bitcoin and now holds 214,400 coins—worth over $13 billion at today’s prices.

Edited by Andrew Hayward