In brief

- PEPE dropped 12% as whales fled, triggering a wave of panic across meme coin markets already rattled by war headlines and macro volatility.

- SPX6900 and Fartcoin tumble hard as charts break down, open interest dries up, and RSI signals shift from euphoria to exhaustion.

- Bitcoin dominance hits 63.83% which signals a potential shift from high risk tokens to safer cryptocurrencies.

Meme coin investors are waking up to a bloodbath Monday, as the sector experiences sharp double-digit declines across the board.

Ethereum token Pepe plunged 12% to $0.000010, SPX6900 dropped 11.55% to $1.40, and Fartcoin fell 8.99% to $1.13 in the past 24 hours. In fact, across the crypto market, only Monero, AB, Form, and Bitcoin SV are showing any gains at all, and they’re less than 1.5%. The question on every trader's mind right now is whether this represents a golden buying opportunity or the beginning of a deeper correction.

The broader cryptocurrency market is experiencing significant selling pressure as geopolitical tensions escalate and traditional markets show signs of strain, creating a perfect storm for risk-off sentiment that's hitting speculative assets particularly hard.

The crypto carnage isn't happening in isolation. Following Israel's wave of airstrikes on Iran last Friday, the S&P 500 dropped and commodities like gold and oil spiked. Bitcoin's dominance rose to 63.83%, a clear sign that investors are rotating out of riskier assets to hedges. In traditional finance, this means going from stocks to commodities; in crypto, this means going from shitcoins to Bitcoin.

Pepe faces whale-driven distribution

Pepe’'s 12% daily decline reflects a confluence of bearish factors that suggest more pain ahead. The technical picture on the weekly chart shows clear distribution patterns: With the price trading a little bit below $0.000010, the coin has broken below critical support levels.

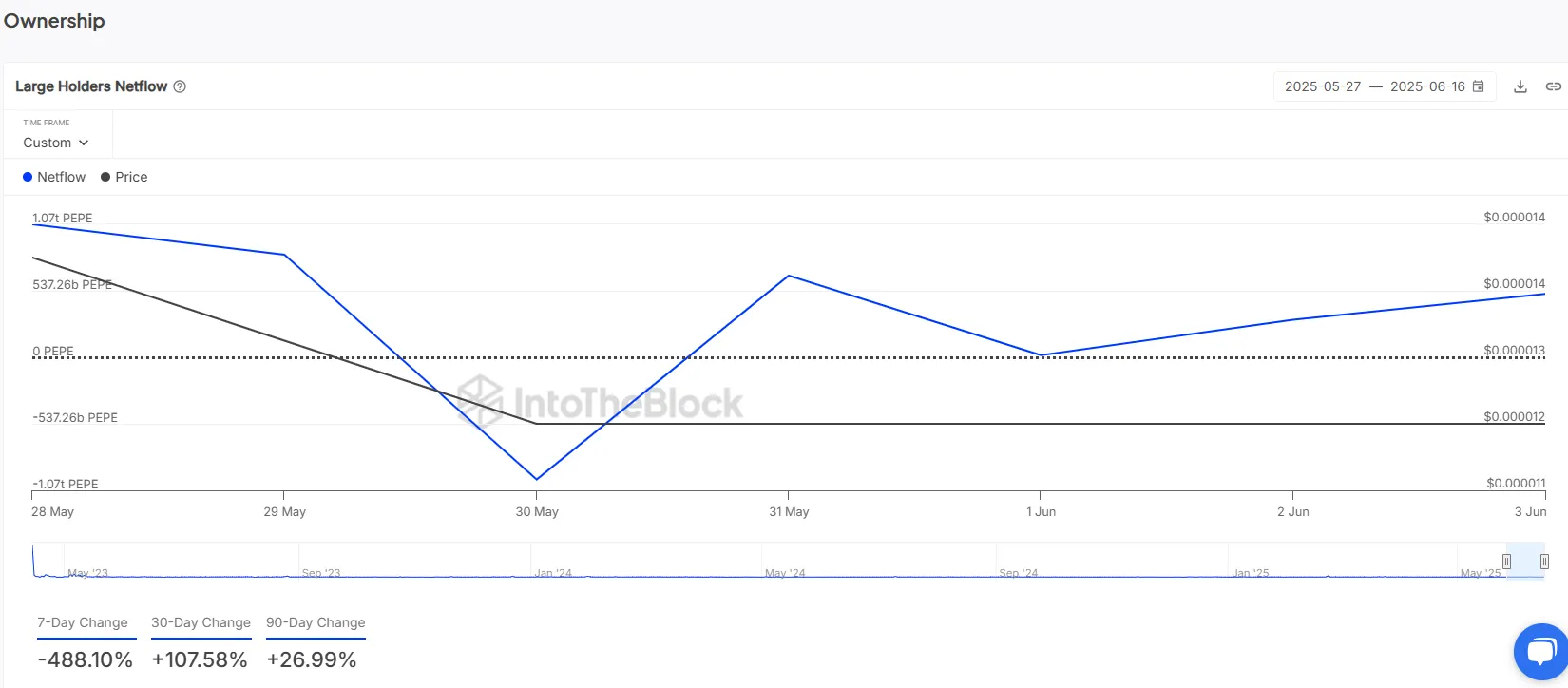

On-chain data showing whale netflows spiked on June 16, signaling distribution and selling pressure. When whales—defined in this case as addresses controlling over 1% of the supply—begin moving tokens to exchanges, it typically precedes significant price declines. There’s little reason to move meme coins to centralized exchanges unless it’s to dump your bags.

Technical indicators paint an equally bearish picture. The Relative Strength Index, or RSI, which measures whether an asset is overbought or oversold, sits at 40.5 on the weekly timeframe, indicating weakening momentum without reaching oversold conditions that might trigger a bounce. The Average Directional Index, or ADX, at 26 shows a trending bearish market gaining strength. ADX measures trend strength regardless of direction.

Key support levels to watch include the $0.0000104 Fibonacci swing low—a break below this level could trigger cascading liquidations and extend losses toward $0.0000085. The 50-day EMA (average price over the last 50 days) at approximately $0.0000118 now acts as resistance, making any recovery attempts likely to face selling pressure.

SPX6900 tests its bullishness

SPX6900's 11.55% drop comes after an extraordinary run that saw the token gain 230% between May and June. Currently trading at $1.50, the meme coin that mockingly positions itself as the S&P 500 of crypto is experiencing a classic case of profit-taking after reaching unsustainable heights.

What comes up, always comes down.

The weekly chart reveals SPX6900 consolidating within a large symmetrical triangle pattern, with the current week's candle threatening to break below the lower trendline. The RSI has cooled from overbought levels above 75 to 69 (no meme), while the ADX at 26 suggests the previous strong trend is losing momentum but is still in play.

Critical support sits at $1.30. A weekly close below this level would confirm the triangle breakdown and could accelerate selling toward $1.08, where the short term EMA provides potential support. The next resistance can be set at around $1.80 if the bullish trend remains solid.

Fartcoin meets market reality

Fartcoin's 8.99% decline might seem modest compared to its peers, and just a normal day in the life of a degen, but the technical setup suggests this Solana-based meme coin faces significant headwinds. Trading at $1.13, the token is struggling to maintain momentum after its parabolic rise.

The daily chart shows Fartcoin trapped within a small short descending channel, with the current week's candle about to test the lower boundary. A broader view shows that even though things look bullish, the token’s last high on June 25 at $1.50 was not able to match May's high mark of $1.60. This could signal that bulls can push for a recovery after a bearish correction, but not enough to sustain the pace it had weeks ago

The ADX reading of 17 indicates a lack of directional strength, suggesting the token is caught in a consolidation phase that could resolve in either direction. However, with the RSI at 37 on the weekly timeframe and 47 on the daily, it appears traders are potentially bearish, trying to sell their coins quickly.

Buy the dip or run for the hills?

The technical evidence across all three major meme coins suggests this correction has further room to run (and in a bad way). The combination of whale distribution in Pepe, derivatives unwinding in SPX6900, and technical breakdowns in Fartcoin paints a picture of a sector experiencing a necessary but painful reset after unsustainable gains.

However, for contrarian investors with strong risk tolerance, these levels might represent accumulation opportunities. History shows that panic selling rarely leads to smart decisions, and markets usually transfer money from the impatient to the patient. But it’s not as if we’re recommending patience (or recommending anything at all, really) with meme coins, which are famous for their short life spans.

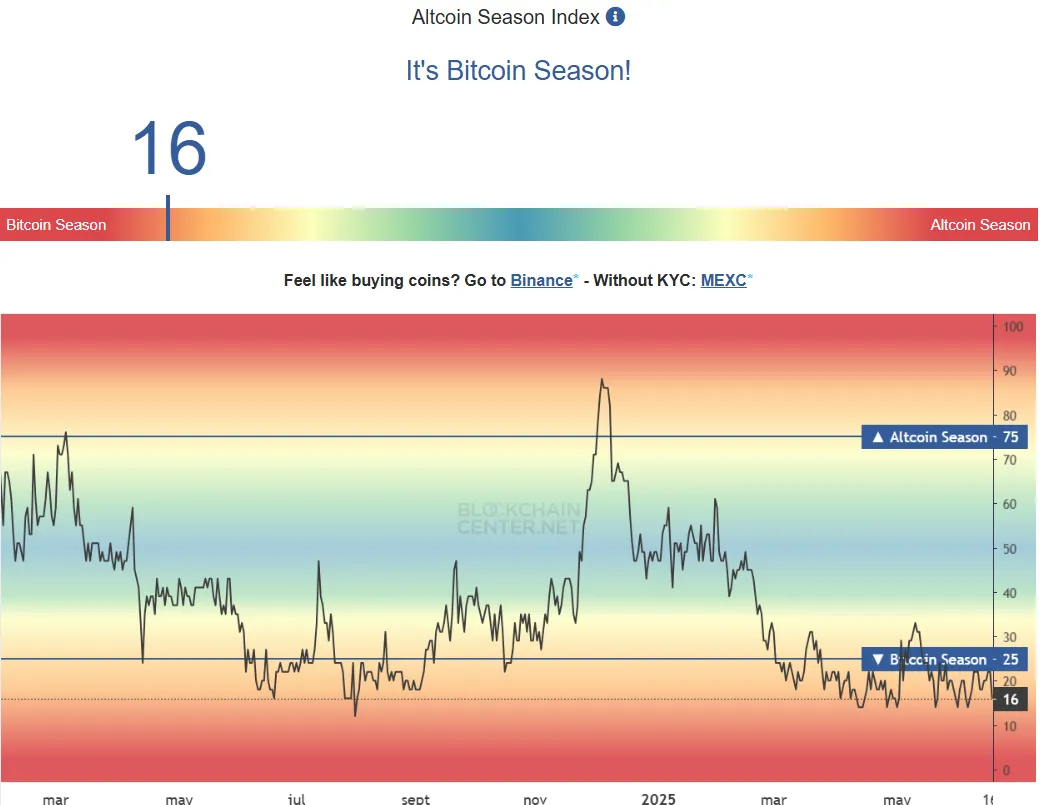

The key differentiator will be Bitcoin's trajectory and the resolution of current geopolitical tensions. If Bitcoin can hold above $100,000 and Middle East tensions ease, meme coins could see a relief rally—mimicking BTC, but with more volatility. But with Bitcoin dominance rising, and the Altcoin Season Index at extreme lows, the path of least resistance appears to be going lower for these speculative tokens.

For traders considering entries, waiting for clear support holds and momentum shifts would be prudent. Pepe needs to reclaim $0.0000118, SPX6900 must defend $1.30, and Fartcoin requires a move above $1.28 to signal potential bottoms. Until then, the meme coin massacre may have a few more casualties to claim.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.