In brief

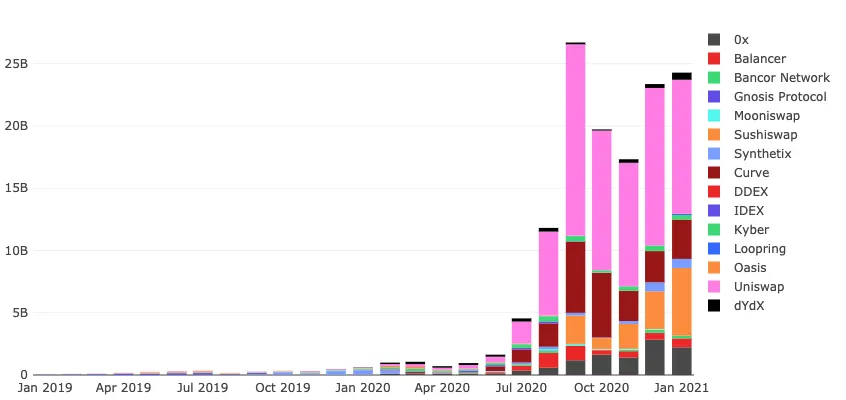

- Decentralized exchange volume is surging, with January already capturing the second-highest monthly volume on record.

- DEX volumes dipped during the fall of 2020.

- Uniswap is still the most popular DEX, but Sushiswap is gaining ground.

Decentralized exchanges are starting 2021 off with a bang. Combined, they are on track to surpass previous all-time high volumes as traders take advantage of the rising price of Bitcoin and Ethereum.

Decentralized exchanges like Uniswap and Curve Finance have already transferred more than $27 billion in transaction volume so far in January, the second-highest total since September 2020’s $29 billion, according to crypto data provider Dune Analytics—and there are still 17 days left in January. At the current rate, decentralized exchanges are on track to process more than $55 billion in trading volume in a single month, close to half of all the volume transacted in 2020.

It looks like decentralized exchanges are all the rage again after losing the spotlight to Bitcoin’s recent all-time highs.

Decentralized exchanges use smart contracts on blockchain networks like Ethereum to let users swap between digital assets without transferring tokens to an exchange wallet or verifying their identity. Decentralized exchanges, also known as DEX, exploded in popularity over the course of 2020, processing nearly $120 billion in transactions compared to just $3 billion in 2019.

Decentralized exchanges and other DeFi trends seemed to stagnate toward the end of 2020; volume fell in both October and November, and rising Bitcoin prices captured the market’s attention. But it seems like some of the gains accrued to crypto holders are going back into the decentralized finance ecosystem, which provides financial services like loans and deposit interest without the need for a centralized bank. Loans outstanding on lending services like MakerDAO, Compound, and Aave have increased more than $175 million since the beginning of 2021.

“Decentralized exchange deposits and volumes have both been growing in 2021,” DeFi lending protocol Aave founder Stani Kulechov told Decrypt. “DeFi is becoming the epicenter of crypto and the trading volumes are starting to reflect that narrative.”

Uniswap remains the most popular DEX, as it has been since March 2020, responsible for more than 45% of volume in the last week. But Sushiswap, a Uniswap copycat project that has begun to innovate in its own right, has grown its market share significantly. From capturing less than 2% of aggregate DEX volume at the end of October 2020, Sushiswap is now the second-largest DEX by volume, accounting for more than 22% of trade volume in the last week.

It's shaping up to be a wild new year for DeFi that could end up dwarfing anything we’ve seen before.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.