In brief

- Trading volume on Uniswap for Wrapped Bitcoin, or WBTC, has risen to a new all-time high of nearly $143 million.

- More than 166,000 BTC have been transferred to the Ethereum blockchain.

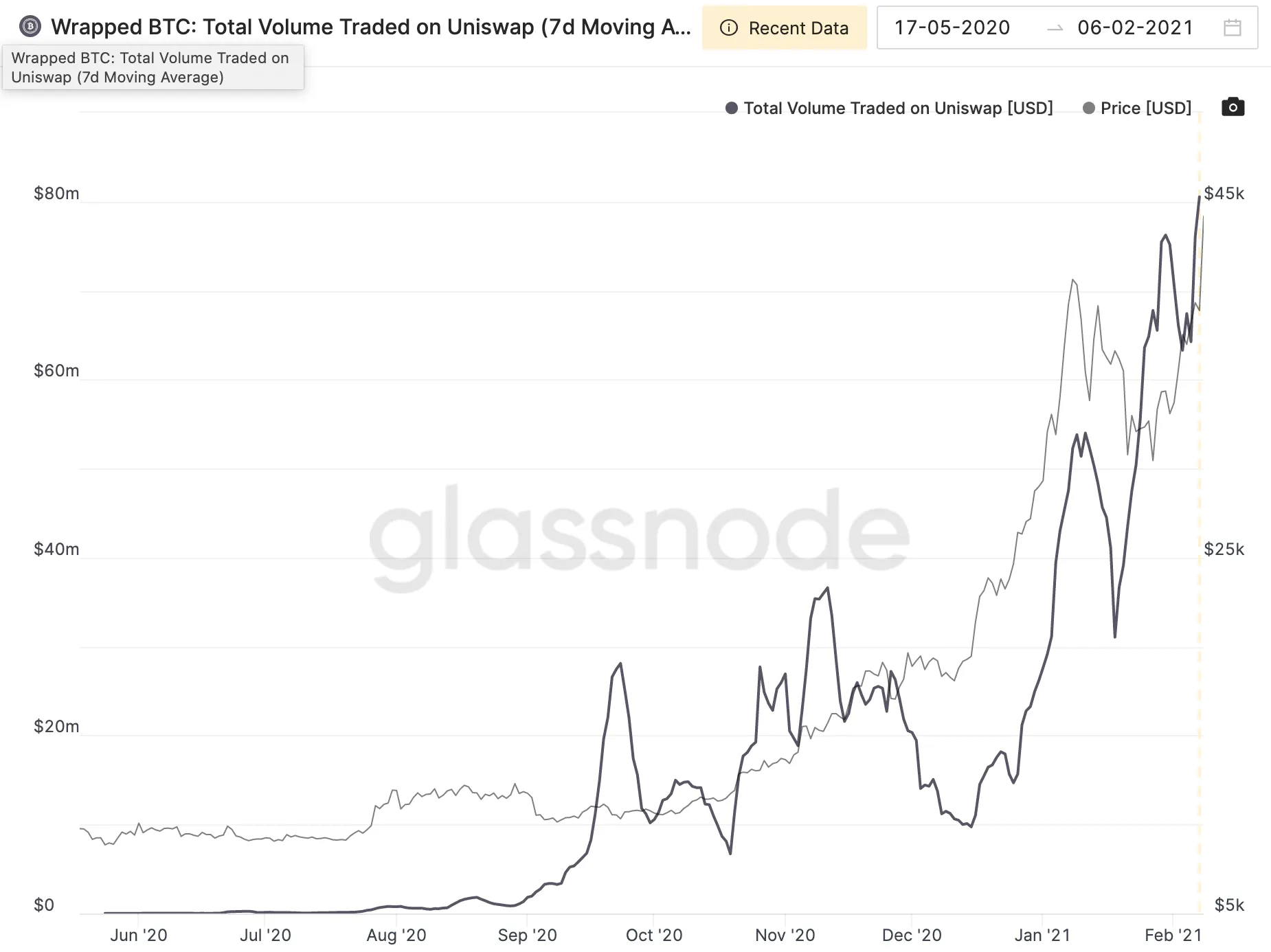

- Daily WBTC trading volume on Uniswap has increased by around 100x since September 2020.

22Bitcoin’s price is near its all-time high, but that’s not the only metric rising to record levels, as Wrapped Bitcoin trading on the Uniswap exchange continues to grow.

Uniswap trading volume for WBTC rose to a new single-day all-time high of nearly $143 million on February 6, according to blockchain data provider Glassnode, part of a stunning rise that has seen Bitcoin worth hundreds of millions of dollars make its way onto the Ethereum blockchain.

WBTC, or Wrapped Bitcoin, has come into its own as a major component of the growing DeFi ecosystem since the summer of 2020. Increased decentralized exchange volume proves that the appetite for on-chain crypto trading is still on the upswing.

DeFi, or decentralized finance, uses automatically executed scripts known as smart contracts to provide financial goods and services such as loans, asset swaps, and interest-bearing deposits using decentralized blockchain networks instead of trusted third parties like banks. DeFi is being developed on several blockchains, but the vast majority of volume and activity currently resides on the Ethereum network.

DeFi offers many opportunities to earn interest on deposits into liquidity or borrowing pools, but Bitcoin and Ethereum use incompatible tech for their blockchain networks. Wrapped Bitcoin was created to help Bitcoin holders get in on the action; by depositing native Bitcoin with a network of trusted custodians, BTC holders can get WBTC in return at a 1:1 ratio.

Of course, WBTC also creates a way for DeFi traders and other Ethereum network users to gain exposure to Bitcoin without needing to set up native BTC wallets and infrastructure. That could help explain Uniswap WBTC volume hitting all-time highs within days of Bitcoin prices pushing to new heights. (Tesla’s Bitcoin announcement has also pushed BTC prices up, of course.)

WBTC volume has been rapidly rising for several months, from an average of less than $1 million per day to closer to $100 million per day since the beginning of February 2020. Combined with other Bitcoin-on-Ethereum tokens like renBTC and tBTC, Bitcoin on the Ethereum blockchain is also currently at its highest-ever level, more than 166,000 BTC or more than 0.75% of the entire Bitcoin supply, according to Dune Analytics.

DeFi keeps on heating up and is attracting more Bitcoin than ever as the bull market snowball effect continues. And with Ethereum the de facto platform for putting crypto-assets to work, who knows how many more BTC will find their way onto the dominant DeFi chain.