In brief

- DeepSeek’s ultra-low-cost AI model shattered the assumption that U.S. chip dominance would indefinitely suppress China’s AI ambitions, triggering a global tech realignment.

- By late 2025, the U.S. and China had severely decoupled their AI ecosystems—splitting hardware, software, standards, and supply chains—while embedding civilian AI advances into military doctrine.

- The rivalry extended beyond bilateral conflict, forcing allies and emerging economies to choose between American-led proprietary control and China’s open-source influence, all while rare earths, data centers, and defense contracts became frontline assets in a new cold war over intelligence itself.

The great unraveling began with a single number: $256,000. DeepSeek, a year-old Chinese startup, claimed it spent that relatively small sum training an AI model that matched the capabilities of OpenAI—which spent over a hundred million dollars to get to the same place. When the app hit Apple's store in January, Nvidia lost $600 billion in a single trading day, which was the largest one-day wipeout in market history.

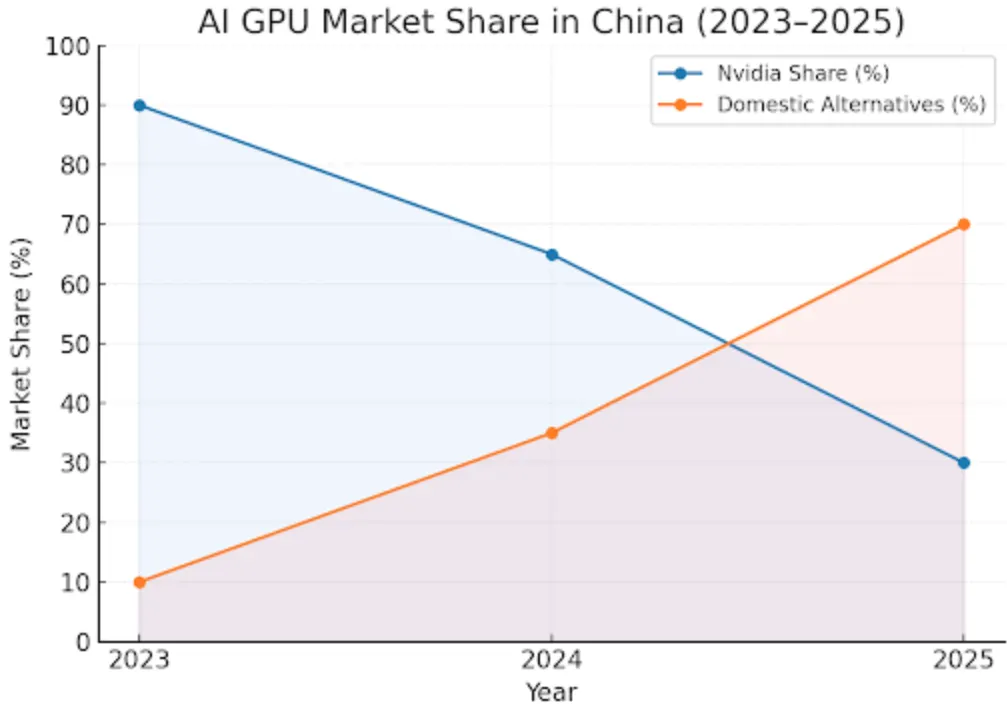

The technical feat aside, DeepSeek’s efficiency breakthrough quickly ignited a global contest far beyond benchmarks or code. Nvidia's China market share had collapsed from 95% to zero. Beijing banned all foreign AI chips from government data centers. The Pentagon signed $10 billion in AI defense contracts. And the world's two largest economies had split the technology stack into warring camps, from silicon to software to standards.

The AI war of 2025 was redrawing the map of global power.

DeepSeek's breakthrough exposed a strategic miscalculation that had defined American AI policy for years: the belief that controlling advanced chips would permanently cripple China's ambitions. The company trained its R1 model using older H800 GPUs—chips that fell below export control thresholds—proving that algorithmic efficiency could compensate for hardware disadvantages.

"DeepSeek R1 is one of the most amazing and impressive breakthroughs I've ever seen—and as open source, a profound gift to the world," venture capitalist Marc Andreessen posted on X after testing it.

Deepseek R1 is one of the most amazing and impressive breakthroughs I’ve ever seen — and as open source, a profound gift to the world. 🤖🫡

— Marc Andreessen 🇺🇸 (@pmarca) January 24, 2025

The AI market entered panic mode. Stocks tanked, politicians started polishing their patriotic speeches, analysis exposed the intricacies of what could end up in a bubble, and enthusiasts mocked American models that cost orders of magnitude more than the Chinese counterparts, which were free, cheap and required a fraction of the money and resources to train.

Washington's response was swift and punishing. The Trump administration expanded export controls throughout the year, banning even downgraded chips designed specifically for the Chinese market. By April, Trump restricted Nvidia from shipping its H20 chips.

“While the Nvidia news is concerning, it’s not a shock as we are in the middle of a trade war between the US and China and expect more punches thrown by both sides,” Dan Ives, global head of technology research at Wedbush Secruities, told CNN.

The tit-for-tat escalated into full decoupling. A new China's directive issued in September banned Nvidia, AMD, and Intel chips from any data center receiving government money—a market worth over $100 billion since 2021. Jensen Huang revealed the company's market share in China had hit "zero, compared to 95% in 2022."

“At the moment, we are 100% out of China,” Huang said. “I can’t imagine any policymaker thinking that’s a good idea—that whatever policy we implemented caused America to lose one of the largest markets in the world to zero.” He called U.S. policy "a mistake" that would backfire by accelerating Chinese chip independence.

He was right. Huawei and domestic players like Cambricon now dominate China's AI infrastructure. By year's end, analysts projected Chinese chipmakers would capture 40% of the domestic AI server market—a stunning reversal from near-total American dominance just three years earlier.

But the semiconductor war was only the surface. Beneath it, America deployed its most potent weapon: control over the economics of the global market, setting up an "AI Action Plan" in July and a policy of tariffs and sanctions aimed at cementing its political and financial dominance.

In response, China began to exert control over the physical elements that make modern technology possible. In October, Beijing announced the strictest rare earth export controls in its history. The new restrictions didn't just limit sales—they applied the Foreign Direct Product Rule to rare earths for the first time, meaning even products made outside China using Chinese rare earth technology would require export licenses. Companies with any affiliation to foreign militaries would be automatically denied.

The target was unmistakable: America's defense industrial base. China controls 94% of permanent magnet production and 90% of rare earth refining—the elements essential for F-35 fighter jets, Tomahawk missiles, and the AI chips that power autonomous weapons. The expanded controls covered holmium, erbium, thulium, europium, and ytterbium, each critical to defense systems.

The U.S. wasn’t caught flat-footed. In July, the Pentagon had invested $400 million in MP Materials, America's only rare earth miner, becoming its largest shareholder. The deal included a 10-year price floor of $110 per kilogram—nearly double the market rate—to protect domestic production from Chinese price dumping. But even with this investment, MP Materials would produce just 1,000 tons of neodymium-boron-iron magnets by year's end—less than 1% of China's 138,000-ton output.

"It's scandalous that we don't have a rare earths strategic reserve," University of Pennsylvania finance professor Jeremy Siegel told CNBC. The supply chain warfare had exposed a vulnerability more fundamental than chip design: America's military depended on adversary-controlled minerals to function.

The AI battle of the titans is continuing. In late November, Trump signed an executive order launching the Genesis Mission—a Department of Energy-led AI initiative the White House compared in "urgency and ambition" to the Manhattan Project.

The Genesis Mission aims to build an integrated AI platform that would harness decades of federal scientific datasets to train "scientific foundation models" and deploy AI agents for autonomous research and discovery. Its goals range from nuclear fusion to advanced manufacturing to semiconductor development, with the platform designed to give American researchers access to supercomputing resources and proprietary datasets no Chinese lab could match.

But whether the $400 million already invested in rare earth mining or the Genesis Mission's national laboratory network can offset China's manufacturing dominance remains unclear—but Washington is now treating AI supremacy as a matter of wartime urgency.

From trade war to actual war?

It turns out that China's advancements were the product of a Military-Civil Fusion Strategy, as the Marine Corps call it. Under Xi Jinping's oversight, China started to create an integrated ecosystem where nearly every technological advance can also serve military purposes.

PLA strategists envision AI transforming not just weapons but warfare itself. Large language models would conduct cognitive operations, manipulating adversary perceptions and decision-making. Swarms of obsolete fighters converted to autonomous drones would overwhelm defenses through sheer scale. The goal: transition to "intelligentized warfare" where speed of decision-making—measured in milliseconds—determines victory.

In the west, Silicon Valley's relationship with the Pentagon also underwent its own revolution. Tech giants that once banned military work now competed for defense contracts worth hundreds of billions. The whole trend started back in December 2024, when Palantir and Anduril announced a consortium to build AI infrastructure for the military.

OpenAI, which had prohibited weapons applications, reversed course and signed defense partnerships with the Pentagon. Google, which abandoned Project Maven in 2018 after employee protests, quietly returned with a $200 million Pentagon contract in July. Anthropic also started to adopt a more anti-China political stance, urging governments to intervene to hinder China's advances and securing a western dominance of the industry.

The battle for the consumer

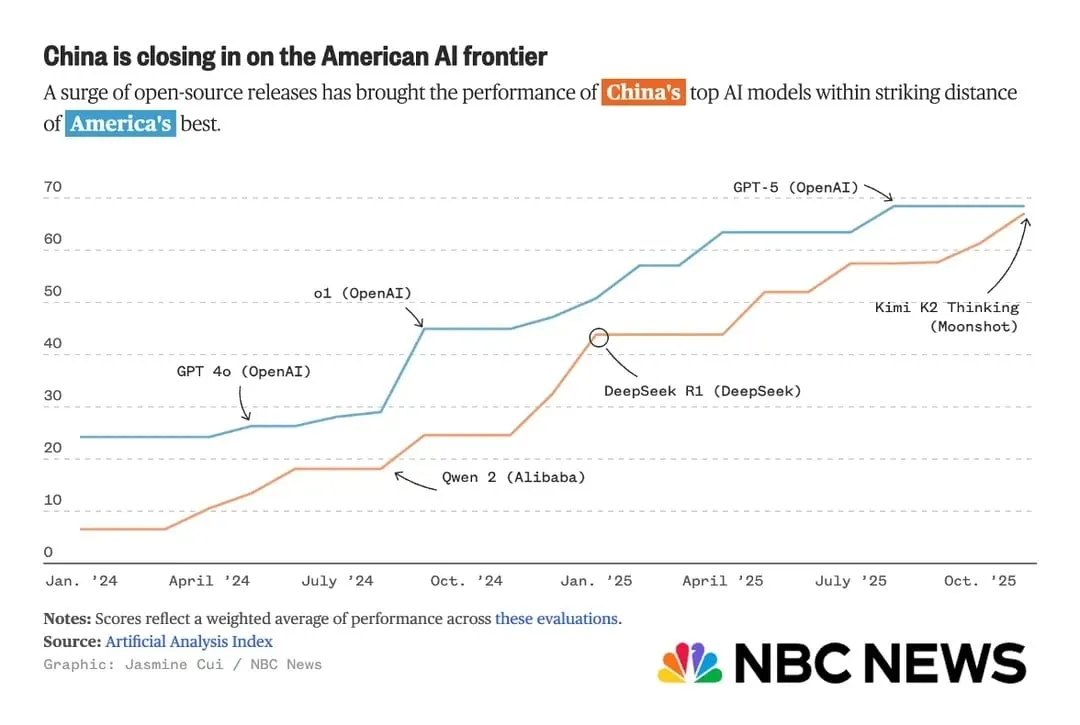

While hardware wars raged and militaries mobilized, American companies staged a comeback in AI's most visible consumer domain: video generation. OpenAI's Sora 2, released in September, set new standards with synchronized audio, 4K resolution, and multi-shot storytelling. Google's Veo 3 and its 3.1 update followed, leveraging unrestricted access to H100 and H200 chips that Chinese competitors couldn't obtain.

Just a few months earlier, China's Kuaishou and other firms had led text-to-video development. Now American firms dominated, proving that in compute-intensive domains, hardware access remained decisive.

The American resurgence extended beyond video to the foundational models themselves. In November, Anthropic released Claude Opus 4.5—what the company called "the best model in the world for coding, agents, and computer use." The model became the first to break 80% on SWE-bench Verified, a benchmark measuring real-world software engineering capabilities, outperforming both OpenAI's GPT-5.1 and Google's Gemini 3 Pro. Anthropic claimed the model scored higher on its internal engineering tests than any human job candidate ever had. For an industry that had spent January panicking over DeepSeek's efficiency breakthrough, Claude Opus 4.5 served as a reminder that American labs still held the performance crown—at least for now.

China vs. world: Open-source models fight it out

2025 was also a great year for open-source models. In fact, one could argue that this was the year open-source AI caught up—and, again, it involved its own dose of the good old China vs America drama.

Alibaba's Qwen family alone accounted for 40% of new language models uploaded monthly to Hugging Face, spawning over 100,000 derivatives and 600 million downloads. The open approach built soft power that export controls couldn't touch—developers worldwide could run Chinese models without restriction, creating a parallel ecosystem independent of American infrastructure.

And how can you prevent a global adoption of free open source models? With regulations.

China's DeepSeek faced bans across dozens of countries. Italy moved first in January, blocking the app over data privacy violations. Taiwan, Australia, South Korea, and multiple U.S. states and agencies followed. By July, NATO allies including the Czech Republic branded DeepSeek a "Trojan horse" for Beijing's intelligence services.

Meta's Llama used to be the most popular LLM in the community; the fourth generation was released this year. OpenAI also released GPT-oss, its only open source model in years. Besides that, the open-source LLM community didn't see much hype in America. Ai2 released a family of models trained in America from scratch, and other companies, including Perplexity, fine-tuned DeepSeek to make it more pro-US and anti-China in its responses.

Not everything is rivalry, though, when developers leave geopolitical fights aside and work towards common goals, they come up with nice products. The models developed by Nous Research—a research team from America, China, Europe and the UAE—is a good example of that.

Besides the China-US Cold-War 2.0, other governments also started to get more involved in AI, setting it as a key element of their public agendas.

Saudi Arabia and the UAE pledged $2 trillion in AI investments during Trump's May visit—money dwarfing American hyperscaler spending. Saudi Arabia's $600 billion commitment included partnerships with Nvidia, AMD, Google Cloud, and AWS to build 2,200 megawatts of data center capacity—more than four times the UAE's 500 megawatts.

Both nations walked a tightrope, wanting American chips and expertise while maintaining deep China ties through Huawei-built telecommunications infrastructure. Washington demanded they choose sides, imposing strict controls to ensure AI hardware didn't reach Beijing or Moscow.

Europe too mounted its own sovereignty bid. The European Commission unveiled a €200 billion InvestAI initiative in April, targeting AI gigafactories and data infrastructure to reduce dependence on American and Chinese technology. But by year's end, the €200 billion remained largely aspirational. Europe allocated just 18% of its €252 billion in venture capital to AI between 2020-2025, compared to America's 34% of $1.33 trillion.

The fracturing carries profound implications. Trade patterns are realigning. Military doctrines are being rewritten around AI-enabled warfare. Developing nations face pressure to choose between eastern and western standards—decisions that will shape their digital governance for decades.

China's bet on open-source democratization versus America's proprietary model represents competing visions of technological power. Beijing seeks influence through freely available tools that create dependencies subtler than export controls. Washington relies on maintaining leads in frontier capabilities and controlling access to the most powerful systems.

Neither strategy guarantees victory. China's open models gain adoption but sacrifice economic returns that fund development. America's closed systems generate revenue but risk irrelevance if developers migrate to unrestricted alternatives. Europe… is being Europe.

What began as a trade dispute over AI chips has metastasized into full-spectrum competition encompassing technology, ideology, resources, and military doctrine. China weaponized its rare earth monopoly. America mobilized its defense industrial base. Both nations fused civilian innovation with military applications in a race toward AI-enabled warfare that has no precedent in history.

The silicon iron curtain that descended in 2025 may prove as consequential as the one that divided Europe for half a century. Only this time, the fault line runs through every smartphone, data center, autonomous system, and permanent magnet that powers modern civilization. The great divide has begun.