In the past few years, thousands of new cryptocurrencies have appeared, all claiming to offer something a little different. Bitcoin was the first, and its value famously rose to around $20,000 in late 2017, then crashed more than 60% in early 2018. Bitcoin took three years to get back to its prior high, and then, at the end of 2020, it doubled in less than a month. In 2021, big companies are buying in, and notable Wall Street skeptics are changing their tune.

Crypto is becoming impossible to ignore.

But let's zoom out. What are cryptocurrencies, how do they work, and why are people so excited by them? You're in the right place to learn.

What is cryptocurrency?

A cryptocurrency is a digital-only token. It uses cryptography (hence the shortened name, "crypto") to regulate how the tokens are created, how they're traded, and how secure they are. And (here's the key appeal for many) it doesn't use or need a central bank or government to control or manage them.

Bitcoin was the first cryptocurrency, created by a person (or persons) using the pseudonym Satoshi Nakamoto, first outlined in October 2008 in a white paper calling the concept "A peer-to-peer electronic cash system." The Bitcoin blockchain, the network on which Bitcoin runs, launched in January 2009. (Nowadays there are many other blockchains.)

In essence, cryptocurrencies are:

- Digital: Cryptocurrencies are completely native to the internet. You can't physically touch or hold them. (Yes, those illustrations of Bitcoins as physical gold coins with a B on them can be misleading.)

- Decentralized: All cryptocurrency transactions are stored on a public, global list or ledger. That means the records are stored in many different places (nodes) at once.

- Peer-to-peer: Cryptocurrencies are exchanged between parties electronically without one central party or middle man needed to approve the transaction.

How are cryptocurrencies created?

Most cryptocurrencies (but not all) generate new units or coins through the process of mining. This is where individuals or groups (miners) use expensive computers that race to solve complicated cryptographic puzzles to verify bundles of transaction records (blocks) to the ledger.

Miners get rewarded for their efforts, which is how new coins get created. (On the Bitcoin blockchain, the mining reward is halved every four years as a measure to slow the creation of new Bitcoins.)

How are cryptocurrencies being used?

These days, there are debates over whether cryptocurrencies really behave like currency, or if they're treated more like commodities. (Some people say they should be called "digital assets" rather than cryptocurrencies.) But cryptocurrencies weren't created just to be an alternative to your $ and £. They can be used for lots of different things. These are just three examples of those that followed Bitcoin:

- Litecoin - the Litecoin blockchain was created in 2011 as a fork (tweak in the code) of the Bitcoin blockchain; its creator Charlie Lee intended it as a silver to Bitcoin's gold. Its token is LTC.

- Ethereum - the Ethereum blockchain launched in 2015 and is specifically designed to power decentralized apps (Dapps) and smart contractson its network. Its token is Ether or ETH.

- Filecoin - the Filecoin network, launched in 2020, allows people to rent computer storage space, like Dropbox for the decentralized web. Its token is FIL.

Bitcoin was invented to be a form of digital money, but since then cryptocurrencies have become more sophisticated.

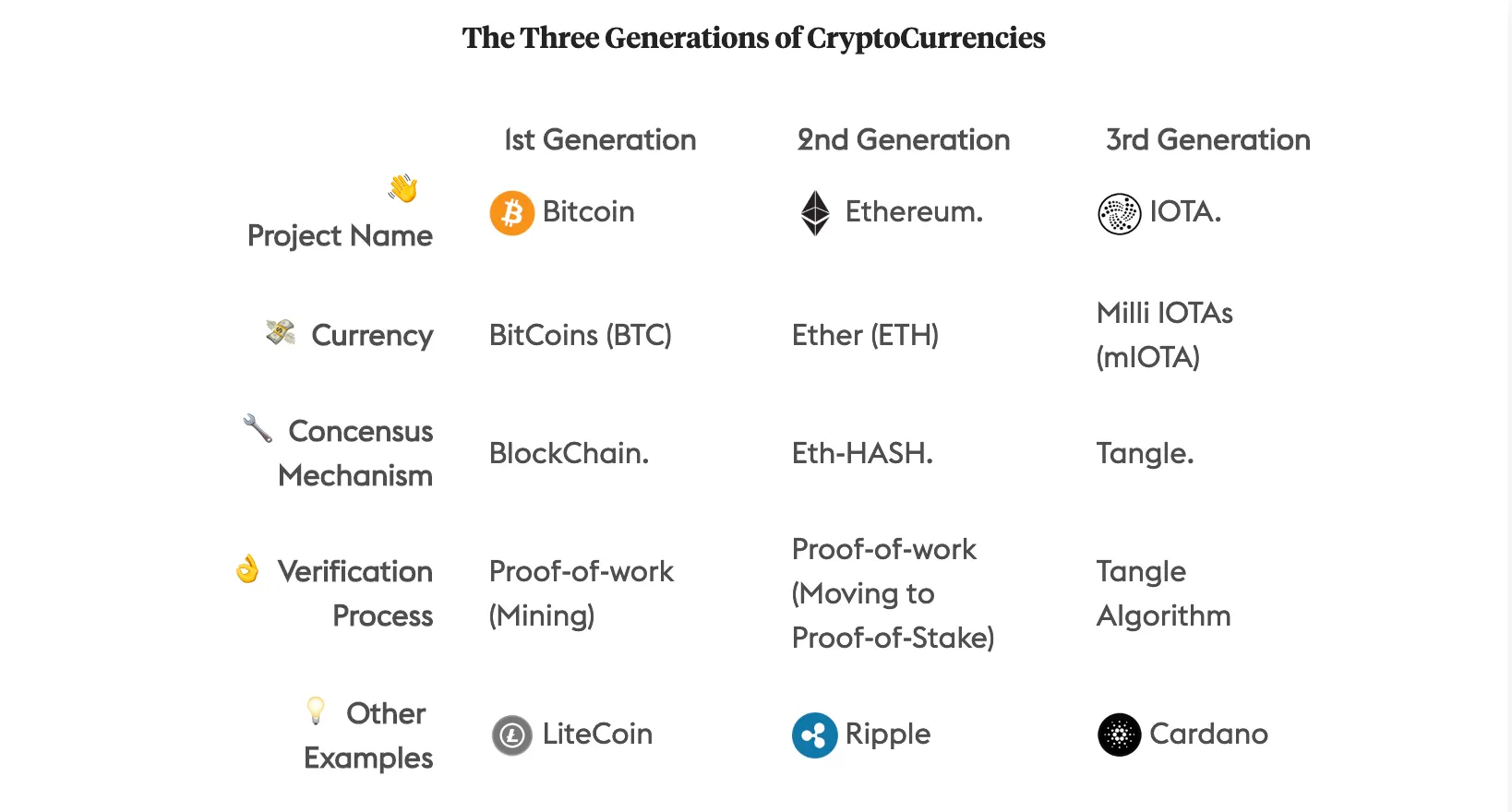

The evolution of cryptocurrencies has been so rapid that to help you understand how it evolved, we've created this table to show how some of the largest cryptocurrencies are trying to solve different problems.

Why are there so many?

Bitcoin was the first cryptocurrency and it solved some of the key problems of creating digital money. But it wasn't without its flaws. (See this article on Bitcoin's limitations.) As a result, developers, entrepreneurs, and programmers have been busy trying to build cryptocurrencies that serve a variety of different needs and fix different problems.

What's the appeal of cryptocurrencies over government-issued currencies?

- They're semi-anonymous. Cryptocurrencies can be designed so that no one can see who you are or what you're spending your crypto on—though the transactions associated with a wallet address are publicly viewable.

- They're not controlled by a government. People in unstable countries where currencies are volatile can use cryptocurrencies as an alternative way to buy goods and services.

- They're borderless. Just like the internet, cryptocurrencies can go anywhere.

- They're more secure. Distributed ledgers are very difficult to hack, since there's no one centralized party in control.

- Transactions are cheaper and faster. While cryptocurrency exchanges do charge fees for you to buy, sell, or transfer your crypto, the fees tend to be much lower than what it costs to move money across borders in the real world—and transactions are verified much faster.

- They can be used to carry out contracts. Cryptocurrencies aren't just used as a form of money. They can be used to store contracts between people, and can carry out these contracts automatically.

The future

We're still right at the beginning of the cryptocurrency age. Many coins will come and go, and some will become incredibly valuable, while others might drop to zero.

But cryptocurrencies as a whole, the technology and industry around them, are here to stay.