The Ethereum network has a lot going for it—it’s decentralized, reliable, supports smart contracts written in a programming language familiar to many crypto developers, and is home to a thriving decentralized finance (DeFi) industry.

However, Ethereum is also slow and expensive to use, and will remain so unless users opt to move to another blockchain (like Solana, Fantom or Avalanche), or until planned Ethereum upgrades speed things up within the next couple of years.

While the world waits, a third fix has arisen: scaling solutions. These are pieces of software that sit atop the base layer of a blockchain, in this case Ethereum, to speed things up. Arbitrum is one such scaling solution, and it’s become a popular venue for Ethereum users to complete their transactions.

On March 23, 2023, Arbitrum plans to airdrop its new ARB token, allowing holders to vote in decisions related to the protocol. In so doing, Arbitrum is enacting its long-awaited transition to a DAO (decentralized autonomous organization).

Arbitrum is cheap and quick to use, and relays all transaction information back to the main Ethereum blockchain. While Ethereum manages a mere 14 transactions per second, Arbitrum races ahead at 40,000 TPS. Transactions cost several dollars to complete on Ethereum, while they cost about two cents on Arbitrum.

And Arbitrum also supports the Ethereum Virtual Machine (EVM), meaning that Ethereum DeFi developers can integrate their decentralized applications (dapps) with Arbitrum without having to make any modifications.

Arbitrum was created by Offchain Labs. The company raised $120 million in a Series B funding round in September 2021.

How does Arbitrum work?

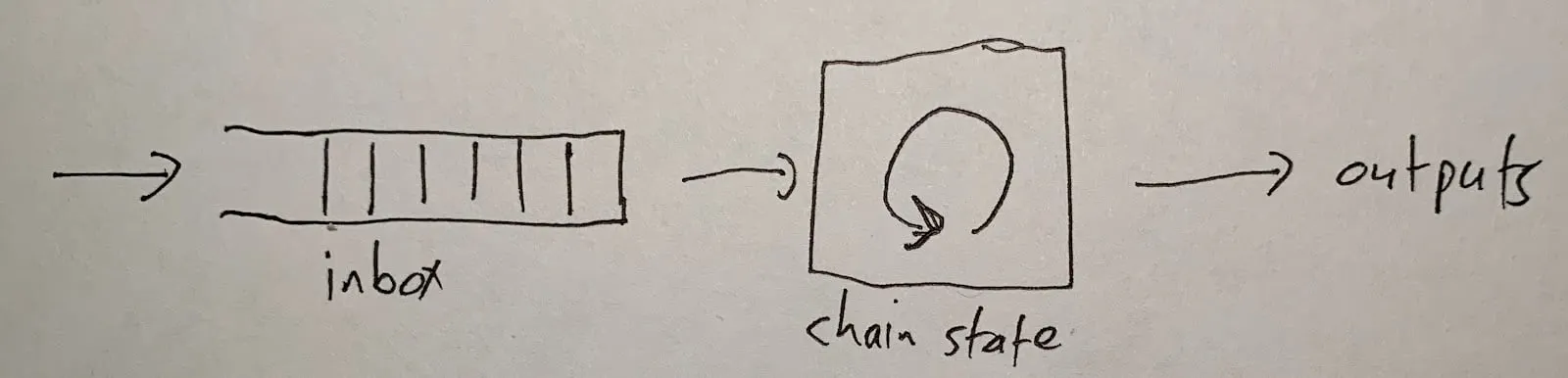

Arbitrum’s development documentation says that this is the most important graph to understand:

Put simply, people and smart contracts ask Arbitrum’s blockchain to do something by placing transactions into the chain's ‘inbox’. Then Arbitrum processes it and outputs a transaction receipt. How Arbitrum processes that transaction—what determines its ‘chain state’—is decided by the transactions in its inbox.

Right now, Arbitrum processes Ethereum transactions through a method called an optimistic rollup, and settles these on a sidechain before reporting back to Ethereum. Let’s break that down.

What is an optimistic rollup?

A rollup is a type of data compression technique for blockchain transactions. It involves ‘rolling up’ batches of transactions into a single transaction.

The benefit of this is that a blockchain need only process a single transaction—the rolled-up transaction—instead of confirming each individual transaction contained within the rollup. This saves time—multiple transactions are confirmed at once, so you do not have to wait until the blockchain gets around to your transaction—and money, since the blockchain only has to confirm one transaction.

An ‘optimistic’ rollup is a specific technique for rolling up transactions. To speed things up, optimistic rollups assume that the transactions contained within the rollup are valid. It is possible to contest transactions through a dispute resolution mechanism if a validator suspects fraudulent behavior. (Optimistic rollups are separate from ‘zero knowledge’ rollups, which bypasses a dispute resolution mechanism by validating transactions before they are added to the rollup).

Optimistic rollups are the present *and future* of Ethereum scaling.

We explain why here:https://t.co/FG0OGC8TJB

— Arbitrum (💙,🧡) (@arbitrum) December 17, 2021

Arbitrum’s optimistic rollups are settled on a proprietary sidechain. A sidechain is a blockchain that is connected to a main chain; in this case, Ethereum. Arbitrum collects batches of transactions, settles them on its sidechain, and then feeds the transaction data back to the Ethereum blockchain ledger.

Arbitrum says that any transactions confirmed through this process are rubber stamped with the “AnyTrust Guarantee”—when all the validators agree with the validity of transactions contained within a block. Validators stake ETH before they can confirm transactions; by putting money on the line, they are incentivized to act honestly.

Unlike other rollup networks, like Boba or Loopring, Arbitrum does not have a token. Offchain Labs claims the network does not need one, since all transactions on the sidechain are settled with ETH, the native cryptocurrency of the Ethereum blockchain.

Arbitrum has been integrated into several decentralized finance protocols, such as SushiSwap, Curve and Abracadabra. Data from DeFi Llama show that $2 billion worth of cryptocurrency is locked up within Arbitrum’s smart contracts. Approximately 30% is from decentralized exchange (DEX) SushiSwap.

The project’s blockchain, Arbitrum One, is in mainnet “beta”, which allows Arbitrum’s developers “various levels of control over the system”, including “the ability to pause the system”. Offchain Labs plans to eliminate these controls once it is certain the project is robust.

How to use Arbitrum

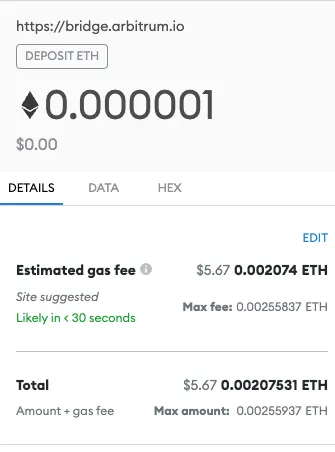

You can use Arbitrum through a decentralized application, like Aave, 1inch or Gnosis Safe, or directly on Arbitrum’s token bridge. For the token bridge, you can deposit funds to the Arbitrum network after you’ve connected your Web3 wallet. It takes about 10 minutes for deposits to clear.

You’ll have to pay an Ethereum gas fee—at Ethereum’s rates. To deposit under a cent of ETH to Arbitrum, MetaMask wallet quoted us $5.41 in gas fees.