In brief

- A significant amount of SUSHI tokens are set to be released from the end of March onwards.

- SushiSwap's community is debating whether the token releases should go ahead.

The community of decentralized exchange (DEX) SushiSwap is wrestling with the issue of an estimated 47 million tokens ($880 million) that are set to be released from the end of March. The concern is that, if some of these tokens are suddenly dumped on the market, the project’s token—which only has a $2.3 billion market cap—could be crushed.

But on the flip side, if SushiSwap reneges on the deals—and some code suggests that the DEX could have the capability to do so—then it would be a slap in the face to those who bootstrapped the project through its early days. Something that DeFi Pulse co-founder Scott Lewis said, “would result in a significant degradation of sushi’s reputation if they ask protocol participants to earn again what is already owed.”

How did this all come about?

Launched on August 28, 2020, SushiSwap is an Ethereum-based decentralized exchange (DEX) that was originally based on Uniswap. It lets people trade tokens directly with other people, without interacting with centralized exchanges or other third parties.

The exchange uses a native governance token, called SUSHI. Anyone holding these tokens can stake them, meaning their tokens are locked up for six months in exchange for rewards. These rewards come in the form of XSUSHI tokens, which receive trading fees from the exchange and have governance rights—enabling them to vote on changes to the network.

In October, yield aggregator Harvest Finance—which automatically invests its users collateral in decentralized finance (DeFi) tokens that offer the highest yield, or interest rates—started supporting SUSHI, enabling its thousands of users to start vesting SUSHI. Other protocols, including Pickle Finance, followed suit.

From around the end of March onwards, 47 million SUSHI tokens ($878 million)—of which Harvest Finance owns around 5-6%—will reach the six-month mark and should become unlocked.

Changing the vesting schedule

On January 28, SushiSwap community member Lukas Witpeerd brought up the issue of the tokens that were set to be unlocked, opening the floor to discussion on how the tokens should be distributed. One option was to just airdrop the tokens all in one go, while another was to allow the tokens to be claimed on a weekly basis, which would incur higher transaction fees for those claiming.

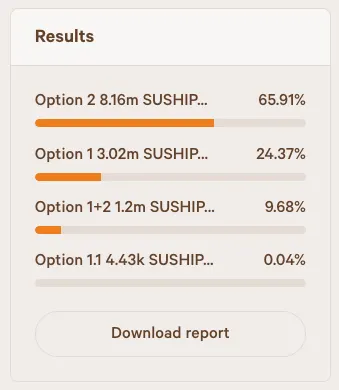

SushiSwap token holders voted for the second option, of a slower distribution of funds. 65% of the turnout voted for this option.

But then SushiSwap’s code was changed in a way that would stop yield aggregators like Harvest Finance from getting its tokens. On March 4, Witpeerd pushed a change to the SushiSwap code, which would continue to allow individual wallet owners to claim their SUSHI, while anyone who interacted with the project via smart contracts would get no tokens. In the case of Harvest Finance, it wouldn’t receive any tokens.

On March 10, a SushiSwap community member known as “Blakells” informed the community why this change was made. The move was made to protect the protocol “from parasitic farms who have only one purpose: market dump sushi to buy back their own token to pump their token price.”

The concern here is that a rival protocol that had built up a large supply of SUSHI might immediately sell all the tokens it receives for its own native token. This would both drive down the price of SUSHI while pushing up the price of their own token.

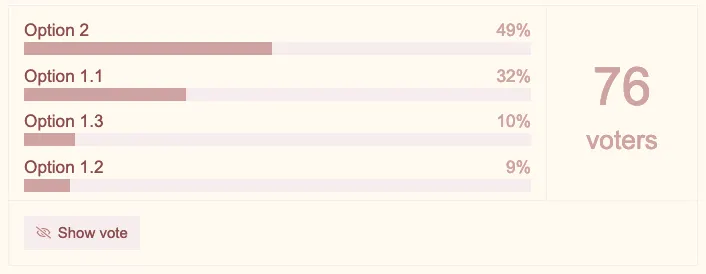

Blakells put forward a plan whereby all protocols that were set to receive SUSHI must make proposals to the SushiSwap community about how they plan to use the funds. He polled the community, giving the options of sticking to this plan (allowing projects an indefinite time to claim their tokens) or putting time windows on them to do so. The respondents backed the initial idea, but had no option to reject the whole plan in its entirety.

Both Pickle Finance and Harvest Finance have submitted proposals so far. Harvest’s plan is to distribute the funds over a three-year period (a long time in DeFi). Pickle’s plan is to continue staking the SUSHI once it receives it and to do so “forever” (an especially long time in DeFi).

Community criticism

The proposal has come under fire for a number of reasons. To begin with, one commentator wanted to know when there was a vote to exclude protocols that used smart contracts from the distribution—a vote that seems to be absent from the SushiSwap forum. Another person added that, because there doesn’t appear to be a governance vote behind the decision, “I hope this decision is rectified. Frankly, it is a rugpull.”

The other main issue that’s been raised is that SushiSwap is changing how the tokens will be distributed, five months after the lock-up period was agreed. The problem is that, when the vesting schedule was announced, it wasn’t coded into the blockchain. That means, rather than the funds automatically going out to the respective parties, such as Harvest or Pickle, the team has to manually send them out. And this control has enabled them to decide how to distribute the funds—or whether to distribute them at all.

“Because we didn’t create a contract, we now have full access over the SUSHI. But we should do what we said we would do,” wrote a SushiSwap community member called “BoringCrypto,” adding, “Changing the rules after the fact feels like [a] ‘breach of contract’ to me.”

Another agreed, saying, “Reputation is everything, and given all of the drama we have gotten past in the last few months, I think it wise to do whatever we can to be good crypto citizens.” That drama includes the occasion when the anonymous creator of SushiSwap cashed out $10 million of SUSHI tokens for Ethereum—only to pass control of the exchange to other developers including FTX founder Sam Bankman-Fried, before eventually handing the funds back. (We have reached out to Bankman-Fried for comment on this story—since there is no official SushiSwap representative, it being a decentralized project—and will update if we hear back).

If SushiSwap can survive such a convulsive event, its community will be hoping that it can get through this relatively minor dispute, too.

Update: This article has been corrected to show that the tokens are set to be distributed from the end of March, rather than the end of April.